Order Flow Chart TradingView Secrets to Unlock the Market

Estimated reading time: 17 minutes

Order flow chart trading on TradingView offers traders an exceptionally powerful and insightful approach to unraveling the intricate and often complex dynamics of the market. By meticulously analyzing real-time buy and sell activity occurring within the markets, traders can gain a substantial and valuable edge that enhances their decision-making process and overall trading performance.

This method allows for a deeper understanding of market behavior, enabling traders to make more informed and strategic choices. Although TradingView does not offer native, fully dedicated footprint or depth-of-market order flow tools that are commonly available in specialized trading platforms, there are several effective workarounds and creative solutions that traders can utilize by leveraging its built-in indicators as well as custom-made indicators designed by the community.

This post uncovers essential and valuable secrets designed to help unlock the full potential of the market by using order flow charts available on TradingView. It is specifically tailored for TradingView users, including intermediate to advanced retail traders and day scalpers who are actively looking for precise market insights and highly actionable trading strategies to improve their performance and decision-making process.

Understanding Order Flow and Its Importance

Order flow trading is an advanced market analysis method that looks beyond past price movements to observe the real-time buying and selling activity driving price action. It involves analyzing how market participants place aggressive market orders or passive limit orders, revealing who controls the market at given price points and where liquidity clusters form.

Imagine it as a tangible and dynamic tug-of-war contest occurring between buyers who are aggressively pushing the price higher and sellers who are simultaneously pulling it down; the order flow reveals which side holds the upper hand at any given moment, providing essential and valuable clues about the potential future direction of the price movement.

Unlike traditional lagging indicators such as moving averages or RSI that rely on historical data, order flow focuses on the immediate market intentions of participants. This direct observation of the underlying demand and supply dynamics helps traders avoid false breakouts and better spot institutional activity, which often causes market moves.

For retail traders looking to transition from reactive to proactive trading, order flow analysis offers a way to “see what the big players see” and follow smart money effectively. This real-time insight can improve timing, risk management, and confidence in trading decisions by revealing exactly how buyers and sellers interact behind the scenes of price charts.

Key Components of Order Flow Trading on TradingView

TradingView, while it does not provide native footprint charts or fully integrated depth-of-market tools, still offers a variety of important features and components that allow traders to effectively simulate and analyze order flow in a meaningful way:

Volume Profile Indicator

The Volume Profile is a powerful tool that displays the amount of traded volume at specific price levels over a selected period of time. This detailed visualization helps traders to more accurately identify key areas of support and resistance, understand market sentiment, and make more informed trading decisions based on where the most activity has occurred during that timeframe.

It provides valuable insights into price levels that have attracted significant buying or selling interest, enabling traders to pinpoint potential entry and exit points with greater confidence.

- High Volume Nodes (HVNs): Price levels where heavy volume indicates strong institutional interest, often acting as support or resistance.

- Point of Control (POC): The price level with the highest traded volume, which frequently acts as a magnet for price action and a key reversal zone.

Traders frequently use these volume clusters as a strategic tool to anticipate potential market reversals or to identify strong trend continuations with greater confidence. The presence of heavy volume at specific price levels often indicates areas where large institutional players or significant market participants have placed their buy or sell orders.

This clustering of volume can provide valuable insights into overall market sentiment as well as potential future price movements. By analyzing these volume clusters, traders and investors can better understand the underlying strength or weakness in the market, helping to predict possible trends or reversals with greater accuracy.

Custom Order Flow Indicators

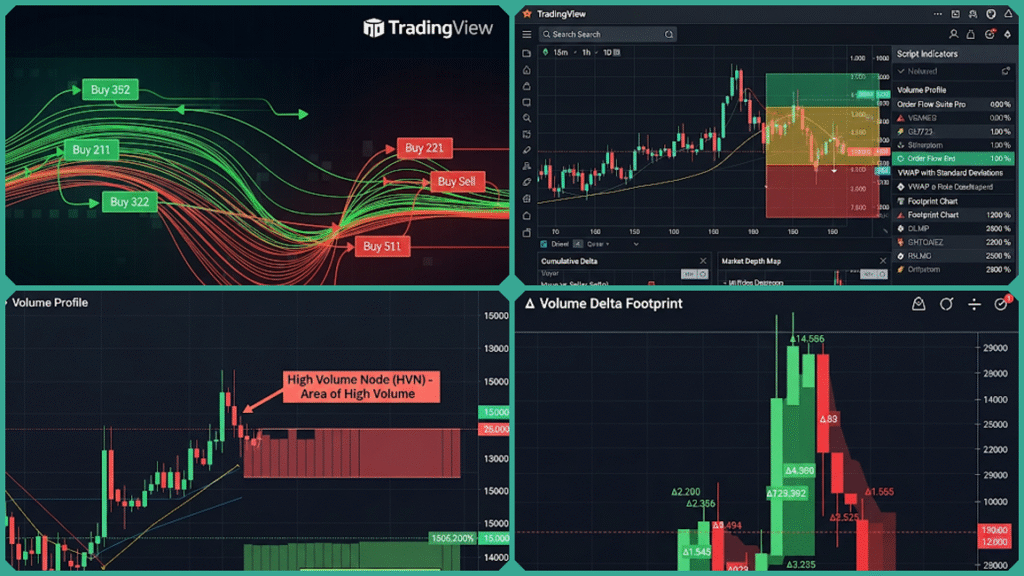

The TradingView Public Library serves as a valuable resource that hosts a wide range of community-built indicators designed to simulate various order flow features. These include advanced tools such as footprint charts and detailed delta volume analysis, which help traders gain deeper insights into market dynamics and trading activity.

By leveraging these indicators, users can enhance their technical analysis and make more informed trading decisions based on order flow data and volume imbalances.

- Indicators show aggressive buying vs. selling volume per candle or price level, revealing the imbalance between buyers and sellers.

- Visualize absorption patterns, where one side’s market orders are absorbed, leading to price rejection or stalled moves.

- Highlight volume clusters within price bars that can signal institutional order activity.

Popular trading scripts such as “OrderFlow Pro+” are designed to detect absorption events effectively and visualize zones where there is significant trading volume accompanied by minimal price movement. These scripts provide traders with actionable insights by clearly identifying key support and resistance zones, helping them make more informed decisions in the market.

By carefully highlighting and focusing on these critical areas, traders gain a much deeper and more comprehensive understanding of the complex market dynamics at play, which in turn enables them to significantly enhance and refine their trading strategies for better outcomes.

Time & Sales (Tape Reading) Analogs

While TradingView does not offer full tape reading capabilities or provide comprehensive DOM (Depth of Market) data, traders can still monitor several important market indicators and information that can assist in their trading decisions:

- Volume per candle, especially combined with color-coded volume bars showing buying or selling pressure.

- Spotting unusually large individual trades or volume surges can hint at institutional activity or order imbalances.

This limited tape-reading approach is particularly useful because it helps to confirm the order flow signals that are observed on volume and delta indicators, providing traders with an additional layer of verification and confidence in their trading decisions.

Together, these various components enable TradingView users to effectively approximate order flow analysis, helping them identify and understand where larger market participants and institutional players are actively operating.

This enhanced insight allows traders to make more informed and strategic trading decisions, significantly improving their ability to navigate the markets successfully, even while working within the inherent limitations of the platform’s native tools and features.

TradingView Secrets to Unlock Order Flow Insights

The secret to unlocking the market’s true potential isn’t always found by searching for a completely different chart. Instead, it often comes down to adopting a fresh and insightful way of interpreting the very same chart you already have in front of you.

TradingView, despite not offering a native order flow chart, provides a rich collection of powerful indicators and advanced features that, when used together thoughtfully and strategically, can give you a significant professional advantage.

Let’s take a moment to pull back the curtain on these hidden ‘secrets’ and learn how to genuinely understand and read the market’s underlying heartbeat with clarity and confidence. Here are key TradingView secrets to unlock order flow insights, combining practical tools and strategies for superior trading precision:

Master the Volume Profile Indicator

TradingView’s native Volume Profile is an absolutely indispensable and highly valuable tool for effectively simulating order flow in the financial markets. This feature visually displays the volume of trades executed at different price levels over a specified timeframe, providing crucial insights that assist traders in understanding market dynamics. By using this tool, traders can:

- Identify High Volume Nodes (HVNs) where heavy trading activity signals strong institutional interest, usually acting as support or resistance.

- Spot the Point of Control (POC)—the price level with the highest volume, often behaving like a magnet, drawing price back or acting as a key reversal point.

- Define Value Areas where most trading volume took place, representing fair value price ranges.

Strategy tip: Use the Point of Control (POC) as a crucial reference zone in your trading strategy—if the price moves toward the POC from above and demonstrates signs of exhaustion or absorption, such as volume clustering or a noticeable slowdown in delta buying, this can often indicate that a reversal in the market trend is likely to occur.

On the other hand, if there is significant absorption of orders below the POC, this behavior can serve as a strong signal that the current trend is set to continue or that the market is preparing for a breakout, suggesting sustained momentum in the same direction.

Leverage Highly-Rated Custom Order Flow Indicators

Explore TradingView’s extensive Public Library to discover a wide range of proven and reliable order flow script indicators, such as:

- Delta Footprint Simulations: Visualize aggressive buying (green) versus selling (red) volumes per price level or candle, helping spot buying/selling pressure.

- Order Flow Imbalance Highlights: Detect price points with significant volume imbalances (e.g., over 300%), often preceding sharp price moves.

- Volume Cluster Markers: Mark price levels where volume is exceptionally high within bars or candles, often indicating institutional activity.

Although they are not as sophisticated or specialized as dedicated footprint software, these tools still offer crucial and valuable insights into the areas where smart money is actively operating. They assist traders by highlighting important patterns and trends, making it easier to distinguish genuine market movements from misleading or false signals that often arise amid the constant noise and fluctuations in the market environment.

Combine Volume Profile with Price Action and Trend Context

Order flow insights become significantly more powerful and valuable when they are effectively integrated with classical market structure analysis, creating a comprehensive approach to understanding market dynamics and price movements.

This combination allows traders and analysts to gain a deeper and more nuanced perspective of market behavior by blending real-time transactional data with established market patterns and trends.

- Use volume profile zones alongside support/resistance and clear trend direction to pick optimal trade entry points.

- Look for order absorption at HVNs in line with prevailing uptrends or downtrends—signifying strong hands defending key levels.

- Recognize stop hunting when prices briefly breach HVNs or POCs with volume clustering and quick delta reversals, a common tactic by large players to trigger retail stops.

This combined approach significantly helps to avoid false or fake breakouts in the market, tightens the placement of stop losses specifically for scalpers and day traders, and greatly enhances the overall quality and precision of trade timing decisions.

Understand Absorption and Exhaustion Patterns

Absorption is a crucial and fundamental concept in understanding order flow dynamics, where aggressive market orders actively consume or hit resting limit orders that are placed at a specific price level. This interaction effectively prevents the price from breaking out beyond that level, acting as a form of resistance or support.

Key signs indicating absorption include several noticeable indicators that reflect the process effectively:

- Lit candles with heavy volume but minimal price movement, showing one side absorbing the other’s pressure.

- Divergence between volume rise and price stalling (delta divergence).

Recognizing absorption in the market enables traders to anticipate whether a current trend will continue or reach exhaustion well before any visible price confirmation actually takes place, providing them with a significant advantage when it comes to timing their entries and exits more effectively and confidently.

By carefully applying these valuable secrets, TradingView users have the opportunity to approximate and gain insights into institutional-level order flow directly within the platform. This enables them to develop and refine high-probability trading strategies that are usually accessible only to those who use more expensive and specialized software tools.

Through this methodical and well-structured approach, traders have the opportunity to significantly elevate the quality and depth of their trading analysis and decision-making processes, bringing them much closer to the high standards typically expected in professional trading environments.

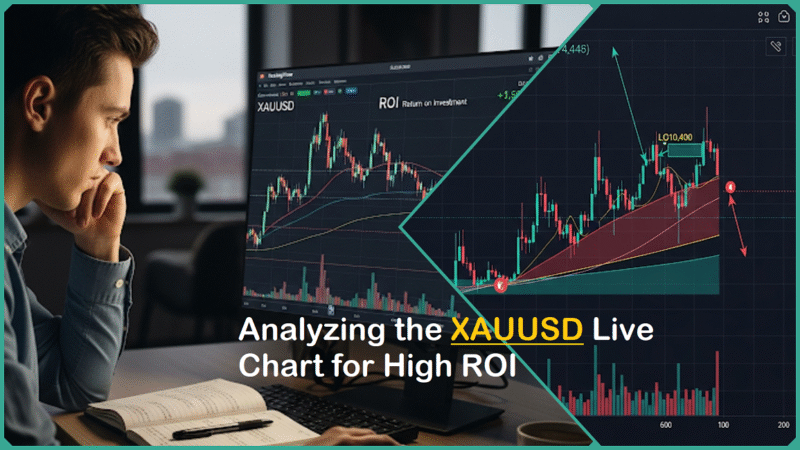

Practical Example: Using Order Flow on TradingView for a Trade

When a theory is sound, the real test is in its application. We are moving from concept to action, providing a step-by-step example of how to combine the TradingView tools discussed previously—Volume Profile, Delta, and price action—to identify a high-probability trading setup. You’ll see how these “order flow secrets” provide confluence and clarity, turning a potential guess into a well-reasoned decision.

Here is a practical example illustrating how to use order flow insights on TradingView for trading EUR/USD on a 5-minute chart:

- Start by applying the Volume Profile indicator on the 5-minute EUR/USD chart. Identify the High Volume Nodes (HVNs) and locate the Point of Control (POC), which is the price level with the highest traded volume; for this example, assume the POC is at 1.1000.

- Next, load a delta simulation indicator from TradingView’s public library. This indicator will show aggressive buying and selling volume at various price levels within each candle. You notice strong, aggressive buying volume near 1.0995, but at 1.1000, the sellers appear to be absorbing this volume.

- Price approaches the 1.1000 level multiple times but fails to break above convincingly, indicating order absorption at this critical level where resting sell limit orders soak up aggressive buying.

- The delta indicator highlights an imbalance with more aggressive buying volume compared to selling volume, suggesting growing buying interest despite the absorption.

- Based on this order flow context, place a buy entry just above 1.1000, setting a stop loss below the absorption zone to manage risk in case sellers regain control.

- As volume and delta confirm the breakout above 1.1000, trail the stop upwards to protect profits while letting the trade run with momentum.

This trade setup combines the powerful Volume Profile tool to accurately identify critical support and resistance zones with advanced delta simulation techniques that allow traders to effectively read buying and selling pressure as well as absorption within the market.

By integrating these two approaches, it provides a significant and concrete edge by enabling the reading of institutional-level order flow dynamics. All of this is achieved on TradingView’s highly accessible and user-friendly platform, making professional-grade market analysis available to a wider range of traders.

Using these techniques, traders can anticipate price turning points with better precision, avoid false breakouts, and enhance their risk management—all while leveraging free or built-in TradingView tools without needing expensive specialized software.

Current Trends and Developments in Order Flow Trading

Current trends and developments in order flow trading on TradingView highlight a dynamic and rapidly advancing landscape that is continuously evolving, fueled by innovative contributions from a vibrant community of traders and developers, as well as the integration of cutting-edge technologies and sophisticated analytical tools:

- Sophistication of Community Indicators: There is a continuous rise in community-developed order flow indicators on TradingView that simulate advanced order flow concepts such as delta, absorption, imbalances, and volume-pressure dynamics. Notable examples include the “Order Flow Delta Tracker,” which offers real-time delta plots, cumulative delta, imbalance detection, absorption signals, and divergence alerts—all tailored to replicate professional-grade order flow analysis within TradingView’s constraints.

- Hybrid Analytical Tools: Traders increasingly use hybrid approaches combining volume profile, delta-based insights, price action, and technical structure. Tools like “Orderflow Pro+” detect absorption zones and dynamically analyze volume thresholds to identify key support and resistance created by institutional players. These hybrid analytics empower traders to build automated alert systems targeting high-probability setups based on combined volume-price behavior.

- Enhanced Market Structure Integration: Indicators such as the “Order-Flow Market Structure” integrate smart money concepts and institutional price action with order flow, automatically detecting shifts in swing highs/lows, break of structure (BoS), and Fibonacci retracement zones, while providing real-time alerts. This fusion supports traders in aligning order flow insights with broader market structure and trend context.

- Growing Educational Ecosystem: The proliferation of YouTube tutorials, TradingView sharing of order flow chart ideas, and community discussions democratizes access to sophisticated trading knowledge. Retail traders worldwide leverage these resources to grasp complex order flow concepts without expensive proprietary software.

- API and External Integration Trends: Some brokers and platforms provide API access to Order Book and Depth of Market (DOM) data, enabling traders to supplement TradingView’s native tools with direct DOM feeds or integrate external data streams. This trend enhances accuracy and depth of order flow analysis for traders willing to combine multiple data sources.

Overall, the prevailing trend in 2025 is clearly moving towards the widespread democratization of order flow trading. This shift focuses on making complex, institutional-level insights much more accessible to a broader audience through the innovative and creative use of TradingView’s highly versatile platform, combined with an array of community-driven tools.

By leveraging these resources, retail traders are now empowered to analyze market data with greater precision and depth, enabling them to compete more effectively and confidently alongside larger institutional players in the increasingly competitive financial markets.

FAQs

Can TradingView provide true footprint or depth-of-market order flow charts?

TradingView does not have native tools for full footprint or Depth of Market (DOM) charts. However, it offers volume profile indicators and a range of custom scripts from its public library that simulate key order flow elements such as delta and volume imbalances. These serve as practical alternatives for retail traders seeking order flow insights without investing in specialized platforms.

What is the difference between volume profile and order flow?

Volume profile shows the amount of volume traded at specific price levels over a period, highlighting important zones like the Point of Control (POC). Order flow, on the other hand, captures dynamic market events including buy vs. sell volume, market order aggressiveness, and absorption patterns, offering a real-time window into market intentions beyond just volume distribution.

How can I use order flow trading to improve entries and stops?

Use volume profile to identify strong support/resistance zones such as HVNs and POCs. Confirm these zones with delta or imbalance indicators to spot when orders are absorbed or exhausted. Timing entries near these signals and placing stops just beyond absorption or imbalance zones can reduce false breakouts and tighten risk management.

Are there free order flow indicators available on TradingView?

TradingView’s Public Library hosts numerous free order flow indicators that provide delta tracking, footprint-style visualizations, and volume cluster highlights. Users should check indicator ratings and reviews to find high-quality and well-supported scripts for their trading style.

Can order flow analysis be used for day trading and scalping?

Order flow analysis is particularly valuable for day traders and scalpers because it provides real-time insight into supply and demand imbalances. This helps precisely time entries and exits and better manage tight stop losses essential for short-term trading success.

In Conclusion

Order flow chart trading on TradingView bridges a vital gap for traders eager to go beyond traditional price indicators without investing in expensive specialized software. By mastering volume profile tools, adopting custom delta and footprint simulation indicators, and understanding institutional order absorption and imbalance, traders gain a clearer window into real-time market dynamics.

These TradingView order flow secrets empower users to anticipate high-probability setups, avoid noise and fake breakouts, and trade more confidently with a sharpened edge. While not a complete substitute for advanced order flow software, these techniques provide significant value and precision for the core TradingView audience, intermediate retail traders, and intraday scalpers alike.

For traders committed to improving performance, practicing order flow analysis consistently on TradingView can lead to more precise entries, effective risk control, and ultimately better trading results—moving from guesswork to informed decision-making.

Discover more from Skill to Grow

Subscribe to get the latest posts sent to your email.