Using Order Flow Analysis on TradingView for Deriv Trading

Estimated reading time: 17 minutes

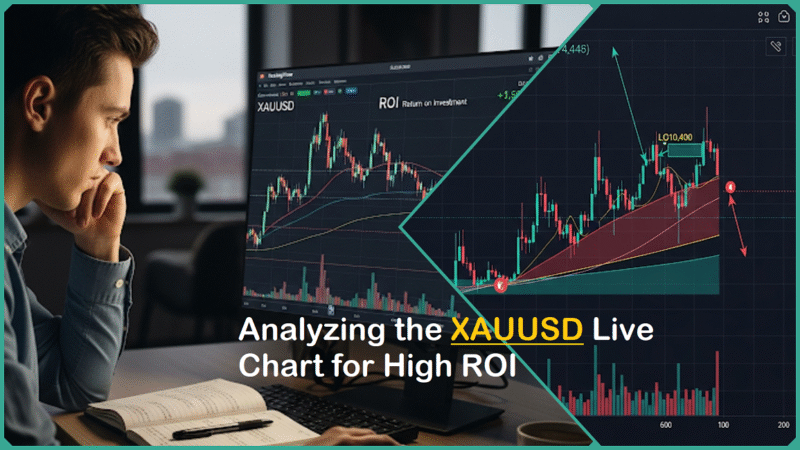

In the complex world of trading synthetic indices, options, and multipliers on the Deriv platform, an edge often comes from understanding market dynamics beyond traditional candlestick charts. One such powerful technique is Order Flow Analysis. This method provides deep insight into market behavior by examining the real-time sequence of buy and sell orders and their impact on price action.

When combined with the highly versatile and comprehensive charting capabilities offered by TradingView, Deriv traders can leverage this powerful approach to make more informed, analytical trading decisions, which come with significantly improved precision and timing. This synergy allows traders to analyze market trends and patterns in greater depth, ultimately enhancing their ability to execute trades at the most opportune moments.

This post delves deeply into the essential fundamentals of order flow analysis, explaining its importance and relevance specifically for Deriv users. It also offers a detailed and comprehensive guide on how to effectively apply this powerful technique using TradingView, helping you to significantly enhance and sharpen your overall trading strategy.

Traders with intermediate to advanced experience who are looking for a more analytical edge will discover valuable practical insights here that can assist in mastering the intricate market mechanics with much greater clarity and confidence.

What is Order Flow Analysis?

Order Flow Analysis is a specialized trading methodology that centers on carefully monitoring and interpreting the continuous, live flow of buy and sell orders within the financial market. Unlike traditional technical analysis, which mainly relies on examining historical price patterns and a variety of technical indicators,

Order Flow Analysis goes deeper by exploring the intricate market microstructure. This approach provides traders with a clearer, real-time view of the actual buying and selling pressure that directly influences and drives the dynamic movements of prices in the market at any given moment.

Key components of order flow analysis include several critical elements that work together to provide a comprehensive understanding of market dynamics. These components encompass :

- Depth of Market (DOM): A detailed visual representation that displays pending limit buy and sell orders across multiple price levels, typically shown as a price ladder. This tool provides traders with a clear view of market liquidity and highlights potential areas of support or resistance by illustrating where other market participants are placing their orders. It helps traders understand the supply and demand dynamics at different price points, offering valuable insights for making informed trading decisions.

- Footprint or Cluster Charts: These specialized charts visually represent the volume of executed trades within each candlestick, broken down at very specific price levels. By doing so, they effectively highlight and reveal the imbalances that exist between buying and selling activity in the market. Unlike traditional charts, footprint or cluster charts show the actual market orders that were executed, providing traders with a more detailed and precise view of market dynamics and order flow.

- Order Imbalances: Situations in the market where either buy orders or sell orders significantly outweigh the other, indicating a strong dominance on one side. These imbalances often signal likely upcoming price movements or highlight important points of interest for traders, such as potential price reversals, breakouts, or areas where significant shifts in market sentiment may occur. Understanding these imbalances can help anticipate future market behavior and inform trading decisions.

- Volume Profile: An aggregated distribution of trading volume spread across various price levels, providing a detailed visualization of where the majority of market activity and trading interest has occurred over a specific period. This tool helps traders identify key price zones with high volume concentration, indicating significant support and resistance areas in the market.

- Market Orders vs. Limit Orders: Differentiating between aggressive market orders, which execute immediately at the best available price, and passive limit orders, which wait patiently for a specific price to be reached before executing. Footprint charts primarily concentrate on showing executed market orders that have already taken place in the market, providing insight into actual trade activity, whereas the Depth of Market (DOM) displays the limit orders that are currently waiting in the order book, representing potential future trades that traders are ready to execute when the market price hits their desired level.

Order flow traders use this granular data to anticipate price direction, identify high-probability trade setups, recognize stop hunts, and detect areas where liquidity pools—features often invisible on traditional candlestick charts.

By analyzing the volume and order imbalances at specific prices and times, traders gain deeper insights into who is in control—the buyers or sellers—and how that control might shift in the near term. This makes order flow analysis a powerful tool, especially for short-term trading strategies like scalping and day trading.

In essence, order flow analysis offers a comprehensive and detailed insight into the real-time behavior, strategies, and intentions of market participants by closely examining the actual buy and sell orders being placed, modified, and executed within the market environment. This approach allows traders to understand the underlying dynamics driving price movements more accurately.

This approach allows traders to gain a deeper understanding of market dynamics as they unfold, enabling them to predict immediate price movements with greater accuracy and confidence compared to relying solely on historical price data or traditional chart patterns. By focusing on the live order activity, traders can anticipate shifts in supply and demand more effectively and make more informed trading decisions.

Why Order Flow Analysis Matters for Deriv Traders

Order Flow Analysis is incredibly important for Deriv traders because it offers a distinct and valuable perspective on the real-time interactions between market supply and demand forces. These insights are essential for making informed decisions when trading Deriv’s unique range of instruments, including synthetic indices, multipliers, and options.

By gaining a thorough understanding of the immediate and real-time flow of orders in the market, traders are better equipped to anticipate upcoming market movements with greater accuracy. This enhanced insight allows them to fine-tune and optimize their trading strategies more effectively, ultimately improving their chances of making profitable decisions in a dynamic trading environment.

Here’s a detailed explanation of why order flow analysis holds significant value when trading on Deriv:

- Synthetic markets are primarily driven by supply-demand dynamics: Since Deriv’s synthetic indices and multipliers simulate market movements in a way that is less impacted by external economic news and events, and because they operate continuously 24 hours a day, 7 days a week, gaining a clear understanding of the actual flow of orders provides a more accurate reflection of true market sentiment and liquidity. This approach offers deeper insights compared to relying solely on traditional price indicators, which can often be influenced by external factors and periodic market closures.

- Precise timing for multipliers and options: These financial instruments require highly accurate entry and exit points in order to maximize potential profits while simultaneously minimizing associated risks. Utilizing order flow analysis allows traders to pinpoint the most advantageous price levels where buying and selling pressures change direction, thereby enhancing the timing for executing trades and increasing the likelihood of identifying potential market reversals. This detailed insight into market dynamics helps traders make more informed decisions and improve overall trading performance.

- Traditional technical indicators can often lag behind the actual market movements or prove to be less effective in certain trading environments. This is especially true in synthetic markets, which frequently display unique and sometimes unpredictable price behavior patterns. Classic indicators such as moving averages or the Relative Strength Index (RSI) may end up generating delayed signals or even false positives and negatives that can mislead traders. In contrast, analyzing order flow provides a more direct and immediate insight into the behavior and intentions of traders, offering a real-time perspective that can be crucial for making informed trading decisions.

- Improves trade win rates: By effectively filtering out false breakouts and providing confirmation of the underlying strength or weakness of price movements, order flow analysis enables traders to avoid common traps and pitfalls in the market. This approach helps traders make well-informed decisions that are firmly grounded in actual market conditions and realities, rather than relying on guesswork or assumptions that can lead to costly mistakes.

The TradingView advanced charting capabilities, when combined with Deriv’s diverse range of trading instruments, provide traders with powerful tools to visualize proxies for order flow. These tools include volume profile indicators, footprint charts, and liquidity zones, which together offer a comprehensive view of market activity.

This indirect visualization significantly enhances strategic decision-making by clearly showing where major orders tend to cluster, how trading volume is distributed across different price levels, and where price movements are most likely to react or reverse. By leveraging these insights, traders can make more informed and confident trading choices.

Current Trends and Developments in Order Flow Trading

Current trends and developments in order flow trading for the year 2025 are primarily focused on the integration and application of cutting-edge technology, along with the broadening of analytical tools, all aimed at significantly improving the accuracy and depth of market insights.

Important trends that Deriv traders, as well as other advanced market participants, should closely monitor include a range of innovative strategies and technological advancements designed to optimize trading performance and decision-making processes.

- Integration of Machine Learning and AI: An increasing number of modern trading platforms are progressively incorporating AI-driven order flow analytics, which are designed to detect complex, subtle, and often hidden patterns within order execution data. These sophisticated algorithms are capable of uncovering intricate market behaviors and dynamics that human traders might easily overlook or fail to identify. As a result, this leads to the generation of more refined, accurate trade signals and the development of highly adaptive trading strategies that can respond effectively to changing market conditions.

- Advanced Footprint Chart Algorithms: Footprint charts have significantly evolved to display real-time delta—the precise difference between buy and sell volumes—enabling traders to accurately gauge the intensity of buying or selling pressure within individual candles. This highly detailed and granular insight provides traders with the ability to time their entries and exits with greater precision, while also offering strong confirmation of the prevailing market direction. By leveraging these enhanced algorithms, traders can make more informed decisions and improve their overall trading performance.

- Multi-Asset Order Flow Visualization: Innovative new tools are now enabling the combined analysis of order flow across a wide range of asset classes, including equities, futures, and cryptocurrencies. This advanced cross-market visualization provides a comprehensive view of how liquidity and order flow in one specific market can have a direct impact on synthetic indices or other financial instruments available on trading platforms like Deriv. By leveraging these insights, traders are better equipped to anticipate and respond to broader market movements, gaining a more holistic understanding of market dynamics and improving their decision-making processes.

- Expanding TradingView Script Ecosystem: TradingView users enjoy the advantage of a rapidly expanding and diverse collection of open-source order flow indicator scripts developed by a highly active and engaged community of traders and programmers. This growing library of scripts significantly enhances the accessibility of advanced order flow analysis, eliminating the need for costly and specialized software solutions. As a result, a broader range of traders can now seamlessly integrate detailed flow insights into their trading strategies, empowering them to make more informed decisions and improve their overall trading performance.

These advances collectively empower traders to gain a much deeper and more timely understanding of supply and demand dynamics, allowing them to refine their entry and exit precision with greater accuracy. Additionally, these improvements enable traders to develop more adaptive and flexible strategies that can respond swiftly and effectively to rapidly changing market conditions.

As order flow trading continues to evolve and expand, staying consistently updated on the latest technological breakthroughs and methodological innovations will be a critical competitive edge for Deriv traders who are seeking to achieve superior and more consistent market performance over time.

Practical Use Case: Order Flow on Deriv Synthetic Indices

A practical and effective use case for applying order flow analysis on Deriv synthetic indices using TradingView involves a series of several important and carefully planned steps. These steps are specifically designed to optimize trade entries, enhance risk management protocols, and significantly improve the overall performance and success of your trading strategy consistently and reliably:

- Volume Profile Indicator on a 5-Minute Chart: Begin by applying the Volume Profile indicator to a 5-minute timeframe chart of a Deriv synthetic index. The Volume Profile visually displays the price levels at which the highest trading volumes have taken place over that period. These areas of concentrated trading activity, known as heavy volume nodes, are important because they often represent key zones where substantial buy or sell orders have been placed. Such zones act as likely order blocks, indicating regions where significant market participants have previously clustered their orders, influencing future price action.

- Mark Potential Support/Resistance Zones: Use the volume profile data effectively to identify and mark these areas of heavy trading volume as important potential support or resistance zones. These specific zones signify price levels where liquidity is particularly abundant, indicating that the price is more likely to react significantly by pausing, consolidating, or even reversing its direction. Recognizing these zones can provide valuable insights into market behavior and help in making more informed trading decisions.

- Observe Price Action at These Levels: As the price nears these critical zones, it is essential to carefully monitor for strong and reliable confirmation signals. These confirmation signals might include specific reversal candlestick patterns like engulfing candles, pin bars, or notable volume spikes that suggest a significant increase in buying or selling momentum. Paying close attention to these indicators can provide valuable insights into potential market direction changes.

- Enter Trades Based on Market Structure and Order Imbalances: Make sure to align your trade entries carefully with the prevailing overall market trend and the underlying market structure. Pay close attention to signals that indicate order imbalances, which occur when buying volume significantly outweighs selling volume or vice versa. These imbalances can provide powerful clues to time your entry points more effectively. For instance, if buyers are clearly dominating near a key support volume node, this situation might represent a very strong signal to enter a long position with greater confidence and potentially higher probability of success.

- Stop Loss Placement Around Volume Peaks: It is advisable to set stop losses just beyond significant volume peaks or prominent liquidity pools in order to provide protection against sudden and unexpected price movements as well as potential stop hunts. These volume peaks often function as magnets that attract price action or serve as strong barriers that price struggles to break through. By placing stop losses in these strategic locations, traders can effectively avoid many common pitfalls associated with volatile market conditions and enhance their overall risk management strategy.

- Manage Trades and Adjust Stops: Once the trade begins to move favorably and successfully breaks through several intermediate volume profile zones, it is important to consider adjusting your stop loss accordingly. You can move the stop loss to the breakeven point to ensure that you do not incur any losses on the trade. Additionally, you may want to trail the stop loss behind specific volume nodes, which helps to lock in accumulated profits while simultaneously reducing overall risk exposure. This proactive management of stops helps safeguard your gains as the trade progresses in your favor.

This method blends quantitative volume-based insights with classical price action analysis, creating a robust and adaptable trading strategy tailored to the unique and continuous market environment of Deriv’s synthetic indices. It enhances decision-making by focusing on where market participants show real interest, improving the timing and accuracy of trades.

FAQs

Can I access real order flow data directly on TradingView for Deriv?

TradingView does not provide native access to raw order book or exact Depth of Market (DOM) data from Deriv. Since TradingView lacks direct tick-level or bid/ask data from Deriv, order flow analysis there relies on volume-based proxies and community scripts that estimate flow dynamics using candle data, volume, and price structure.

What are the best TradingView indicators for order flow analysis?

Some of the most popular and highly effective community indicators include:

- Order Blocks + Order-Flow Proxies: Uses break of structure and volume-based proxies like delta (buy/sell imbalance estimates), cumulative delta, and effort vs. result measures to highlight potential order flow zones.

- OFA – Order Flow Analysis: Detects fractal structure breakouts and measures the magnitude and velocity of price legs to infer order flow strength and momentum.

- Volume Profile and footprint-type scripts also contribute valuable visual cues on supply/demand zones and executed volumes within candles on TradingView.

How does order flow analysis improve trading performance on Deriv?

Order flow analysis offers a granular look at market activity and liquidity by approximating where aggressive buyers or sellers operate. This improves trade timing, confirms trend strength, and helps avoid false breakouts or lagging signals typical of traditional indicators. It provides an edge by decoding real-time supply-demand imbalances hidden in volume and price structure data.

Is order flow analysis suitable for beginners?

Order flow analysis is better suited for intermediate to advanced traders because it demands familiarity with trading concepts like market structure, volume interpretation, and technical charting. Beginners should build a solid foundation in price action and volume basics before progressing into more complex order flow techniques.

Can order flow strategies be automated on Deriv using TradingView?

Partial automation is possible, such as setting TradingView alerts based on order flow indicator signals or market conditions. However, full automation of order flow-based strategies requires advanced integration beyond standard TradingView features, often involving third-party bots or custom algorithmic trading platforms tailored for Deriv.

These valuable insights, which encompass the use of proxy indicators such as order blocks and delta estimations, assist Deriv traders in effectively incorporating order flow concepts into their TradingView analyses despite the inherent limitations of the platform.

By leveraging these techniques, traders can significantly enhance the precision of their trading strategies and improve their overall awareness of market dynamics, allowing for more informed decision-making and better trading outcomes.

In Conclusion

For Deriv traders aiming to elevate their strategies, mastering Order Flow Analysis on TradingView offers powerful insights into the underlying market forces beyond traditional charts. By leveraging tools like the volume profile, identifying order blocks, and interpreting supply-demand imbalances, traders gain an analytical edge that helps them spot high-probability trade setups and optimize risk management effectively.

While TradingView doesn’t fully replicate all features of order flow data, such as raw Depth of Market (DOM) or precise order book details, creative use of volume-based indicators, custom scripts, and footprint chart proxies brings valuable market depth insights directly to your TradingView charts on Deriv.

This sophisticated and comprehensive approach enables traders to gain a deeper understanding not only of what the market is currently doing but also the underlying reasons and factors driving its movements, thereby empowering them to execute trades with greater precision and confidence.

Embracing order flow analysis is especially important on Deriv’s synthetic indices and multipliers, where traditional price and indicator signals can lag or produce false moves. Order flow principles clarify trader intentions through the real-time aggregation of executed orders and liquidity zones, offering a competitive edge in timing and direction.

For traders who are eager and ready to deepen their mastery and enhance their skills, there are valuable resources available to support their growth. These resources include comprehensive free guides, specially designed custom TradingView scripts, and insightful expert tips.

All of these advanced tools are specifically designed to assist traders in expanding and refining their order flow strategies in a more effective and precise manner. They are tailored to perfectly fit the unique, ever-changing, and dynamic markets that are exclusively offered by Deriv, helping traders to navigate and capitalize on these market conditions with greater confidence and skill.

Take your Deriv trading to the next level: Sign up for our free guide on advanced order flow strategies!

Receive expert insights, custom scripts, and more delivered directly to your inbox — start mastering the microscopic flow of the market today.

This comprehensive strategy aligns perfectly with the needs of intermediate to advanced, analytical Deriv traders familiar with TradingView, offering actionable, data-driven methods grounded in proven order flow principles.

Discover more from Skill to Grow

Subscribe to get the latest posts sent to your email.