$Million Business Failure: Lessons from Sujimoto’s Story

Estimated reading time: 15 minutes

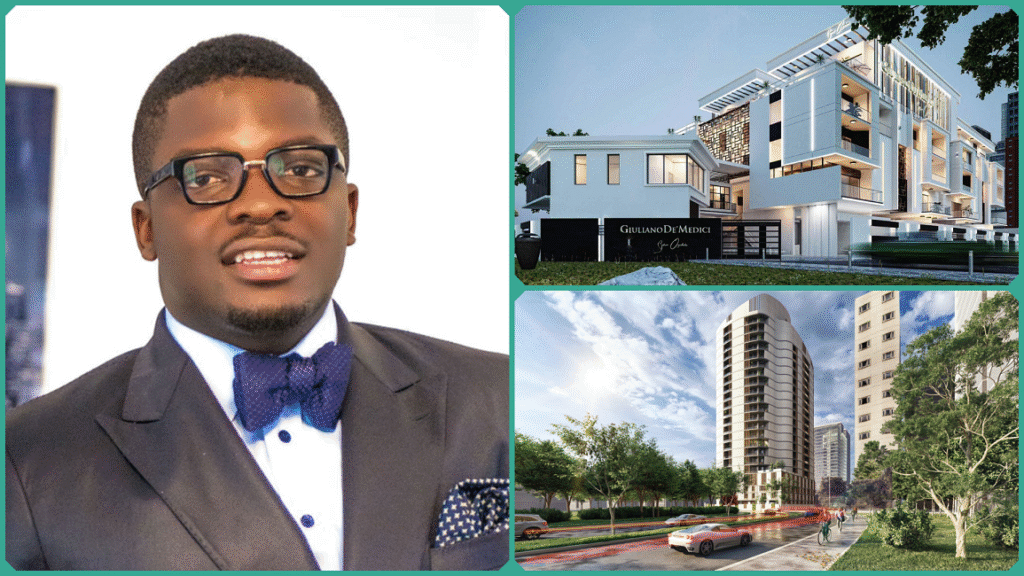

Success stories often take the spotlight, yet it is the tales of failure that provide invaluable lessons for both budding and seasoned entrepreneurs in the fast-paced realm of entrepreneurship. The journey of Sujimoto, a luxury real estate developer in Nigeria, offers a striking example of how bold ambitions and visionary projects can encounter unexpected obstacles, resulting in notable setbacks.

Business failure, especially on a million-dollar scale, is both a financial and emotional ordeal. For entrepreneurs and business leaders, understanding such failures is not about dwelling on loss but about learning how to anticipate risk, manage crises, and build resilience. Sujimoto’s experience, marked by a liquidity crisis, import dependency issues, and regulatory hurdles, reflects broader systemic challenges that many businesses face, especially in developing markets.

This post targets entrepreneurs, business owners, students, finance and law professionals, and curious readers who want to understand the nuanced realities behind headline-grabbing business failures. By dissecting Sujimoto’s journey, we aim to spotlight practical business lessons, encourage resilience, and deepen understanding of the complexities that challenge even the most ambitious ventures.

Key Concepts and Theories Behind Business Failure

Before delving deeply into Sujimoto’s intriguing story, it is essential to gain a clear understanding of several foundational concepts and key factors that frequently serve as the primary reasons behind business failure:

Liquidity Crisis

This situation arises when a business lacks sufficient readily available cash or liquid assets, such as cash equivalents, to meet its immediate and short-term financial obligations. Experiencing such a crisis often leads to significant operational disruptions, damaging the company’s ability to maintain smooth day-to-day functions.

Additionally, it severely undermines crucial relationships with suppliers and employees, creating a loss of trust and confidence. If this liquidity issue is not addressed and managed effectively promptly, it can quickly escalate into insolvency, putting the entire business at risk of failure.

Supply Chain Dependency

Businesses that depend extensively on imported materials or foreign suppliers expose themselves to a wide range of risks, including currency fluctuations, unexpected tariffs, delays in shipping, and various geopolitical disruptions.

This heavy reliance on external sources can lead to significant cost volatility and increased unpredictability, which in turn can jeopardize not only project timelines but also overall profit margins and business stability. Managing these risks requires careful planning and contingency strategies to mitigate potential negative impacts on operations.

Regulatory Environment

This refers to the comprehensive set of laws, regulations, and bureaucratic procedures that dictate and control the way a business operates within a particular industry or region. When these regulations are inconsistent, overly complex, or suffer from a lack of transparency, they create significant obstacles for businesses.

Such challenges can result in increased compliance costs, delays in operational processes, and, in some cases, may even lead to legal disputes or penalties that can affect the overall stability and growth of the business.

Strategic Planning and Risk Management

These critical frameworks involve not only setting clear and achievable long-term goals but also continuously identifying, analyzing, and proactively preparing for a wide range of potential risks that could impact the organization.

Effective strategic planning ensures that businesses remain highly agile and adaptable, enabling them to respond swiftly and effectively to ever-changing market dynamics, emerging industry trends, and internal challenges that may arise over time. This comprehensive approach allows organizations to maintain a competitive edge and sustain long-term success in an unpredictable business environment.

Resilience in Business

Resilience in the context of business is defined as the capability to quickly recover from adversity, effectively adapt to unexpected and often challenging changes, and consistently maintain smooth business operations despite disruptions.

This important quality empowers companies to not only withstand difficulties but also to transform failures or setbacks into valuable opportunities for growth, innovation, and long-term success. Building resilience is particularly critical in today’s fast-paced and volatile economic environments, where uncertainty and change are constant factors that businesses must navigate to survive and thrive.

Gaining a deep understanding of these concepts offers a valuable lens through which we can thoroughly explore the complex and multifaceted factors that contributed to Sujimoto’s business failure, allowing us to carefully analyze the situation and extract practical, actionable lessons that can be applied in future endeavors.

The Sujimoto Saga: Business Challenges Unpacked

Sujimoto made a name for itself by pioneering ultra-luxury real estate developments in Nigeria, aiming to deliver world-class homes and commercial spaces that would redefine the luxury property market. The company’s bold vision and rapid growth attracted significant attention and acclaim, positioning it as a game-changer in the industry.

However, hidden beneath this ambitious and impressive facade were critical vulnerabilities that, over time, gradually surfaced and ultimately led to significant and sometimes overwhelming business challenges and setbacks:

Liquidity Issues

Sujimoto’s ambitious projects demanded a significant amount of upfront capital, which was frequently invested in land acquisition, ongoing construction activities, and the procurement of high-quality imported materials. The combination of delays in property sales and prolonged payment collection cycles led to serious cash flow bottlenecks, placing considerable strain on the company’s ability to manage its daily operational expenses.

As a result, these financial constraints caused delays in settling payments to vendors, suppliers, and contractors, further exacerbating the situation. This ongoing liquidity crunch ultimately restricted the company’s capacity to maintain smooth and uninterrupted operations over an extended period.

Import Reliance

One of the most significant features that distinguished Sujimoto’s luxury properties was their use of exceptionally high-end finishes and premium fixtures, all meticulously sourced from reputable international suppliers.

However, this heavy reliance on imported materials and products made the company particularly vulnerable to the challenges posed by Nigeria’s ongoing foreign exchange shortages, stringent import restrictions, and the inherent volatility of the local currency.

The constant fluctuations in foreign exchange rates, combined with bureaucratic inefficiencies and delays in clearing imported goods at customs, frequently led to substantial increases in costs. Moreover, these unpredictable delays caused project timelines to become uncertain and extended, complicating planning and delivery schedules.

Regulatory Headwinds

The Nigerian real estate sector is characterized by a complex and constantly evolving set of regulations that pose significant challenges. Frequent bureaucratic delays in obtaining necessary approvals, along with continuously changing compliance requirements, have substantially increased both the administrative burdens and overall operational costs for Sujimoto.

This ongoing regulatory uncertainty has not only hindered smooth project execution but has also disrupted effective long-term strategic planning, making it difficult to forecast and manage future developments with confidence.

Market Volatility

The economic environment in Nigeria, especially within the luxury real estate segment, experienced significant instability influenced by various macroeconomic factors and evolving demand patterns. These ongoing fluctuations created a challenging landscape that exposed Sujimoto to increased risks related to pricing strategies, the speed at which properties were sold, and the overall confidence of investors in the market.

As a result, successfully navigating this highly volatile and constantly changing environment required not only careful attention but also the implementation of adaptive measures designed specifically to manage and mitigate these significantly heightened uncertainties effectively and efficiently.

Together, these deeply interconnected challenges generated significant financial distress and numerous operational setbacks that ultimately overshadowed the company’s initial promise and potential. This situation clearly illustrates how even the most visionary and innovative projects can become vulnerable and face serious difficulties if there is not a strong and effective management system in place to properly identify, assess, and mitigate the underlying risks involved.

Current Trends and Developments Impacting Business Stability

Understanding the specific challenges faced by Sujimoto within the broader context of ongoing business trends offers valuable insights into the constantly evolving landscape of risk and opportunity that companies must navigate.

Several significant and influential trends are actively shaping the overall stability and success of businesses as we approach the year 2025:

Global Supply Chain Disruptions

The far-reaching ripple effects of the COVID-19 pandemic, combined with escalating geopolitical tensions across various regions, continue to place significant strain on supply chains around the world. These disruptions—which include a wide range of challenges such as labor strikes, political conflicts, and climate-related disasters—contribute to increased volatility and unpredictability in sourcing materials and managing logistics operations.

In response, businesses are increasingly adopting strategies that focus on diversifying their supplier base and localizing production processes. This approach helps reduce their reliance on fragile and complex global supply routes while also mitigating risks associated with tariffs, trade restrictions, and fluctuating currency values.

Additionally, cutting-edge technologies like artificial intelligence and predictive analytics are being leveraged to enhance supply chain visibility, strengthen resilience, and boost adaptability, allowing companies to respond more effectively to real-time changes and challenges.

Digital Financial Solutions

Significant advances in financial technology have provided small and medium-sized enterprises (SMEs) with access to a wide range of sophisticated tools such as real-time cash flow monitoring, automated invoicing systems, and innovative alternative financing options, including supply chain finance and various forms of digital lending.

These cutting-edge innovations play an increasingly crucial role in helping businesses manage their liquidity more effectively, enabling them to accurately anticipate potential cash shortfalls and strategically optimize their working capital. By leveraging these digital financial solutions, businesses can avoid costly operational disruptions and maintain smoother day-to-day operations with greater confidence and efficiency.

Regulatory Reforms

A growing number of developing economies are actively pursuing initiatives to digitize and streamline their regulatory processes. These important reforms significantly enhance transparency and minimize bureaucratic delays, thereby making it considerably easier and more efficient for businesses to comply with existing laws and secure the necessary permits and licenses.

Despite these advancements, successfully navigating the continuously evolving regulatory landscape still demands proactive engagement and the support of strategic legal counsel to effectively mitigate compliance-related costs and potential risks.

Sustainable Business Practices

There is a rapidly growing interest among investors and consumers alike in environmental, social, and governance (ESG) criteria, which is increasingly compelling companies across various industries to fundamentally rethink and reshape their operations.

By incorporating sustainability principles into every aspect of their supply chains, production methods, and governance structures, businesses are not only gaining a significant competitive advantage but are also preparing to meet potential regulatory requirements that may soon become mandatory.

This proactive approach to sustainability helps foster long-term business resilience, ensuring companies can thrive in an evolving market while contributing positively to the environment and society.

Resilience Building Frameworks

Many organizations today are increasingly adopting comprehensive and formalized frameworks such as Business Continuity Management (BCM) to better prepare for, respond to, and recover from various types of disruptions. These structured frameworks place a strong emphasis on critical activities like thorough risk identification, detailed contingency planning, and the implementation of rapid recovery mechanisms.

By focusing on these essential components, businesses are equipped not only to survive unexpected shocks and crises but also to adapt quickly, remain flexible, and foster innovation even while operating under significant pressure and challenging circumstances.

These emerging trends clearly emphasize that the future of achieving long-term business stability heavily relies on a combination of agility, transparency, and proactive risk management. These critical areas are essential for entrepreneurs and business leaders to prioritize and concentrate on, especially when navigating through highly volatile and unpredictable markets such as those encountered by Sujimoto.

Focusing intently on these crucial key aspects will significantly better equip businesses to successfully adapt, survive, and ultimately thrive despite the numerous challenges posed by constantly fluctuating economic conditions and unpredictable market uncertainties.

Lessons from Sujimoto’s Business Failure

Sujimoto’s journey in navigating the highly competitive and often challenging Nigerian luxury real estate market provides numerous valuable and critical lessons for businesses that aspire to not only survive but truly thrive amid the constant volatility and uncertainty that characterize such dynamic environments:

Robust Financial Management is Absolutely Non-Negotiable

Sujimoto’s extensive experience clearly underscores the critical importance of proactive and continuous cash flow monitoring, along with securing flexible and adaptable financing arrangements. Maintaining substantial emergency reserves is essential, as it can effectively prevent liquidity crises that have the potential to severely disrupt or completely derail ongoing projects.

As Sujimoto’s CEO emphasized, having reliable access to flexible financing options and the capability to efficiently manage cash flow are absolutely crucial components for success, especially in cash-and-carry environments such as Nigeria’s dynamic and often unpredictable real estate market.

Reduce Import Dependency

Sujimoto’s heavy reliance on imported luxury materials made the company particularly vulnerable to Nigeria’s frequent foreign exchange shortages and strict import restrictions. These challenges significantly increased costs and caused delays in project completion.

By investing more in developing and strengthening local supply chains, Sujimoto can effectively reduce these risks. This approach will lead to greater cost stability, improved control over project timelines, and a more resilient business model that is less affected by external economic fluctuations.

Navigate Regulatory Environments Strategically

Achieving success in highly volatile and constantly changing markets requires the deliberate effort to build and maintain strong, collaborative relationships with regulators and legal advisors. By doing so, businesses can more effectively manage complex compliance requirements and navigate regulatory challenges with greater ease.

This proactive approach allows companies to anticipate potential bureaucratic delays and stay ahead of evolving standards and regulations, significantly minimizing unexpected obstacles or surprises that might otherwise cause costly disruptions or stall critical progress.

Strategic Risk Planning

Incorporating comprehensive and detailed risk assessments along with thorough scenario planning into the overall business strategy is absolutely vital for long-term success. Gaining a deep understanding of market volatility, evolving economic trends, and sector-specific challenges enables organizations to be better prepared for potential disruptions.

This approach also significantly enhances overall agility, enabling companies to swiftly and effectively adjust their operations promptly in response to rapidly changing conditions and newly emerging risks that may arise unexpectedly.

Brand and Reputation Management Matter

Transparent and open communication during times of crisis plays a crucial role in maintaining the trust of stakeholders and preserving the overall credibility of an organization. Sujimoto’s unwavering commitment to delivering high-quality products, coupled with its clear and inspiring vision, has been instrumental in sustaining ongoing interest and confidence among clients and partners, even amidst significant market challenges and uncertainties.

This approach emphasizes the critical importance of maintaining consistent transparency and a steadfast dedication to core values as essential factors in effectively protecting and continually enhancing the overall reputation of a brand over an extended period of time.

Failure as Part of Growth

Perhaps most importantly, Sujimoto’s story truly embodies the powerful principle that failure is often not the end but rather a crucial step along the challenging path to eventual success. By embracing setbacks as valuable learning opportunities, maintaining unwavering determination, and consistently focusing on long-term goals, individuals and businesses alike can transform moments of crisis into powerful catalysts for innovation, development, and sustained growth over time.

These lessons clearly demonstrate that although the challenges faced in emerging markets can often be quite daunting and complex, implementing strategic financial controls, maintaining a strong awareness of risks, prioritizing local sourcing, and fostering resilience are essential pillars.

These elements collectively form the foundation for building a sustainable, resilient, and ultimately successful business operation in these dynamic environments. Here is the carefully drafted blog post section focusing on the “Key Concepts and Theories Behind Business Failure”:

FAQs

What caused Sujimoto’s business failure?

Sujimoto’s challenges stem from a combination of liquidity problems due to delayed payments and sales, heavy reliance on imported luxury materials exposed to foreign exchange shortages, regulatory hurdles in project approvals, and market volatility in the luxury real estate sector. Additionally, recent controversies such as investigations over alleged fraud related to delayed project deliveries have negatively impacted the company’s reputation and operational stability.

Can business failure be predicted early?

While it is difficult to predict every failure, early warning signs can be identified through regular financial audits, diligent monitoring of cash flow, continuous risk management, and market trend analysis. Being proactive enables businesses to take corrective actions before issues become critical.

How can businesses avoid import dependency risks?

Diversification of suppliers, investment in local manufacturing capabilities, and maintaining strategic inventory reserves are effective strategies. These reduce exposure to foreign exchange fluctuations and import logistics disruptions, enabling more predictable project timelines and costs.

What is the role of resilience in business recovery?

Resilience enables a business to absorb shocks, adapt to changes, and continue operations during crises. It transforms failures into opportunities for innovation and growth, fostering long-term sustainability despite setbacks.

Are such failures common in developing markets?

Businesses in developing economies often face additional challenges such as infrastructure gaps, inconsistent regulatory environments, and currency volatility. These factors heighten the risk of failure, although they can be mitigated with robust strategic planning and risk management.

In Conclusion

Sujimoto’s million-dollar business setback reflects more than just a company’s struggle—it encapsulates the realities many entrepreneurs face in volatile environments. The lessons learned emphasize the critical need for robust financial controls, strategic supply chain management, regulatory fluency, and a resilience mindset.

Business failure should not be viewed as an endpoint but as a valuable learning curve in the entrepreneurial journey. By studying Sujimoto’s experience, entrepreneurs and business leaders are reminded that preparation, adaptability, and perseverance are essential to transforming challenges into sustainable success.

For entrepreneurs navigating the complexities of today’s globalized yet unpredictable markets, Sujimoto’s story is a call to action: proactively manage financial health, build resilient supply chains, engage constructively with regulators, and maintain an unwavering spirit. These steps create a sturdier foundation for long-term enterprise success.

Discover more from Skill to Grow

Subscribe to get the latest posts sent to your email.