Top 13 Job Guarantee Programs with Income Share Agreements

Estimated reading time: 20 minutes

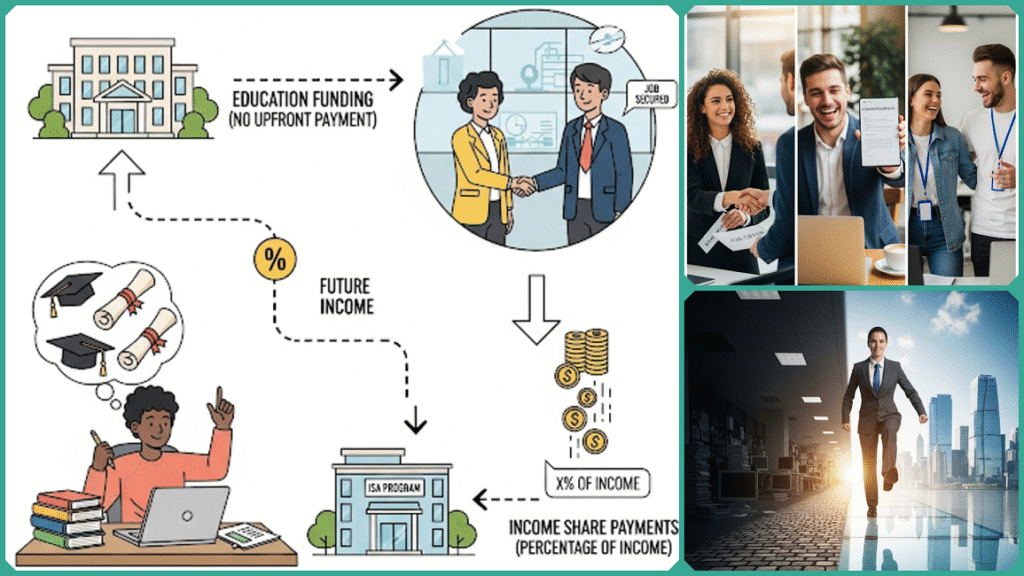

Navigating a career change or breaking into the tech industry can be daunting, especially when financial constraints and uncertainty about job prospects are significant barriers. This is where Job Guarantee Programs coupled with Income Share Agreements (ISAs) come into play, offering a revolutionary solution for career changers, recent graduates, and risk-averse job seekers.

These programs promise not only to equip you with in-demand tech skills but also provide a safety net—with Income Share Agreements removing the upfront payment barrier and job guarantees, minimizing financial risk by ensuring tangible employment outcomes.

In this post, we will take an in-depth look at what job guarantees and Income Share Agreements (ISAs) entail, explaining their definitions and how they operate in practice. We will also carefully weigh the advantages and disadvantages associated with both options to help readers make informed decisions.

Additionally, we will present a thoughtfully curated and comprehensive list of the top 13 programs specifically designed to empower individuals by providing the necessary skills and resources to successfully transition into lucrative, high-paying roles within the technology sector.

Understanding Job Guarantee Programs and Income Share Agreements

A Job Guarantee Program is a form of educational offering where the provider commits to helping students secure qualifying employment after completing the program, often within a specified timeframe. If the student does not find a job meeting the program’s criteria—such as a minimum salary level or role relevance—the program may offer full or partial tuition reimbursement, deferred tuition, or suspension of Income Share Agreement (ISA) payments.

This guarantee is designed to significantly reduce the financial risk for students by assuring that their investment in education and learning will directly lead to genuine and meaningful job opportunities in their chosen field. It aims to give students confidence that their time and money spent on acquiring new skills will result in tangible employment outcomes.

An Income Share Agreement (ISA) is a financial arrangement designed to make education more accessible by eliminating upfront tuition fees. Instead of paying tuition before or during the program, students agree to pay a fixed percentage of their future income after graduation—and only after surpassing a minimum income threshold—for a defined repayment period or until a payment cap is reached.

Income Share Agreements, therefore, help to significantly reduce the initial financial barriers that students often face when pursuing their education. Additionally, they align the educational provider’s incentives directly with the students’ success in gaining meaningful employment after completing their studies. This alignment encourages providers to focus on delivering quality education and career support.

Income Share Agreement Key Features

- No upfront tuition or a small initial deposit: Students often do not have to pay any tuition fees in advance or are only required to make a minimal initial deposit before commencing their studies. This approach helps reduce financial barriers and makes it easier for students to start their education without significant immediate costs.

- Income-based payments: Students are required to pay a fixed percentage of their gross monthly income, which usually ranges between 10% and 17%. This payment method adjusts according to the amount they earn each month, ensuring that their loan repayments remain manageable based on their current financial situation.

- Income threshold to start payments: Payments will commence only if a student’s annual income surpasses a predetermined minimum threshold, which is typically set within a range of approximately $33,000 to $60,000. This means that no payments are required unless the student earns more than this specified income level during the year.

- Defined payment duration or cap: Repayment typically extends over a period ranging from 1 to 4 years, or continues until the student reaches a predetermined maximum repayment limit, which is often calculated as a multiple of the initial amount funded. This structured timeframe helps ensure that borrowers have a clear understanding of their repayment obligations and the total amount they are expected to repay within a set period.

- Payment deferral or forgiveness: If students are unable to secure qualifying employment or their income falls below the specified threshold, their loan payments may be temporarily paused or, in some cases, completely forgiven. This provision ensures that borrowers facing financial difficulties are given relief and are not burdened with repayment obligations they cannot meet.

This model works as a risk-sharing mechanism between the student and the education provider (or investor). Since repayments are tied to employment and income level, students avoid debt burden without jobs, and providers are motivated to help students gain relevant skills and employment.

In Summary

Job Guarantee Programs coupled with Income Share Agreements offer students not only a comprehensive education but also a clear and structured pathway to meaningful employment, all while significantly reducing the financial risks typically associated with pursuing new skills or careers.

This combination is particularly appealing to career changers who are looking to transition smoothly into new fields, individuals who may have limited savings and cannot afford upfront costs, and those who desire a strong assurance that their investment in training will lead to tangible job outcomes and career advancement opportunities after completing their education.

Why Choose Job Guarantee Programs with Income Share Agreements?

Choosing Job Guarantee Programs that incorporate Income Share Agreements (ISAs) offers numerous significant advantages, making them an exceptionally attractive and practical pathway for a wide range of individuals. These include

- Career changers looking to pivot into new industries

- People facing financial constraints who need affordable education options

- Risk-averse job seekers who want to minimize upfront costs

- Recent graduates searching for strong career opportunities

- Underemployed workers who are striving to break into competitive tech fields

Here’s a more detailed and comprehensive look at why these programs consistently stand out in the crowded marketplace and provide unique, distinct benefits for individuals who are aiming to advance, develop, or completely transform their careers in meaningful and impactful ways:

Accessible Financial Terms

One of the main advantages of Income Share Agreements is that students can start their education without massive upfront tuition payments or taking on burdensome loans. Instead, they agree to pay a percentage of their future income only once they reach a minimum salary threshold, typically between $33,000 and $60,000 annually.

This innovative model effectively removes a common and significant financial barrier, thereby enabling individuals who have limited savings or minimal credit history to pursue their career goals with considerably less stress and anxiety about the immediate costs involved.

By alleviating the upfront financial burden, it provides greater access and opportunity for people to invest in their professional development without the usual monetary constraints that often hinder progress.

Risk Mitigation with Job Guarantees

Job Guarantee Programs provide an added layer of security by assuring students that if they do not secure qualifying employment within a set timeframe after graduation, they may be eligible for full or partial tuition refunds, deferred Income Share Agreement payments, or pauses in the agreement.

This guarantee reduces the financial and emotional risk of investing time and money in training for a new career, offering peace of mind that the program will support job placement or refund tuition if employment goals aren’t met.

Focused Career Pivot into High-Demand Tech Fields

These programs specialize in equipping students with specific, in-demand skills such as software development, data science, cybersecurity, and full-stack web development. Given the robust demand for tech talent and the significant salary potential, graduates are well-positioned to pivot into growing industries with clear upward mobility.

The career-focused curriculum, combined with an outcomes-driven approach, is specifically designed to support individuals in transitioning swiftly into the workforce, securing well-paying and lucrative roles that offer long-term career growth and stability.

Comprehensive Support Services

Many programs go beyond just technical instruction to include mentorship, career coaching, interview preparation, and employer networking. This holistic support increases the chances of graduates landing relevant jobs and thriving in their new careers.

The Income Share Agreement model strongly encourages educational institutions to actively invest in their students’ overall success and future career prospects, as the financial return for the institution is directly dependent on graduates securing employment with competitive and sustainable salaries.

This alignment of interests motivates schools to provide robust support, quality education, and career services to help ensure their students thrive in the job market.

Additional Benefits Highlighted by Experts and Research

- Income Share Agreements provide an advantage for more effective financial planning because they feature fixed income percentage payments that are directly linked to your actual earnings. This flexibility contrasts with traditional loans, which require fixed monthly payments that remain the same regardless of how much income you generate. As a result, Income Share Agreements offer a more adaptable and manageable repayment structure that aligns with your financial situation over time.

- The interests of both the funder and the student are closely aligned and interconnected; schools have significant and compelling incentives to consistently maintain high placement rates as well as to provide quality training programs that effectively prepare students for their future careers.

- Income Share Agreements (ISAs) play a crucial role in democratizing access to education by significantly lowering the initial financial barriers that often prevent non-traditional and underresourced learners from pursuing their educational goals. By offering an alternative funding model, ISAs enable a broader and more diverse group of students to invest in their education without the immediate burden of upfront tuition fees, thereby fostering greater inclusivity and opportunity in the educational landscape.

Experts like Zakiya Smith (Lumina Foundation) emphasize that Income Share Agreements represent educational institutions “putting their money where their mouth is,” reinforcing commitment and accountability to student outcomes. Also, a software entrepreneur, observes that Income Share Agreements emotionally de-risk the decision for students leaving jobs to pursue bootcamps, making career changes more accessible and less intimidating.

Overall, choosing job guarantee programs that include Income Share Agreements (ISAs) offers a well-rounded approach by balancing various important factors such as improved access to education, significant risk reduction, practical and hands-on career training, along continuous support throughout the process.

This combination makes these programs especially appealing and highly attractive for individuals who are actively seeking greater confidence, clear direction, and a more secure pathway during their career transition journey.

Top Job Guarantee Programs with Income Share Agreements in 2025

Here is an in-depth and comprehensive summary of the Top 13 Job Guarantee Programs with Income Share Agreements (ISAs) in 2025 that offer career changers and job seekers valuable access to technology education, all while incorporating robust financial safeguards to ensure a secure and supportive learning experience:

| Program Name | Tech Skills Taught | Income Share Agreements Terms Summary | Job Guarantee Terms | Mode & Length |

|---|---|---|---|---|

| App Academy | Software Engineering | 15% income for 36 months, $50K income threshold, max $31K | Tuition refund if no job in 6 months | Full-time/Part-time, in-person & online, ~16 weeks |

| Bloom Institute of Tech (BloomTech) | Data Science, Full-stack, Web3 | Two Income Share Agreement options: 14% income for 36-48 months, $50K threshold, max ~$38-43K | Job guarantee with Income Share Agreement pauses if no qualifying job is found | Online, self-paced & full-time, 6-12 months |

| General Assembly | Web Dev, UX Design, Data Science | 10% income for 48 months, $40K threshold | Tuition refund/job guarantee within 180 days | Full-time/Part-time; in-person & online, 12-24 weeks |

| Coding Temple | Full-stack Web Development | 12% income for 36 months, $33K threshold, cap $22K | Full tuition refund if no job in 6 months | Full-time, online or in-person, 10 weeks |

| Fullstack Academy | Software Engineering, Cybersecurity | 12% income for 48 months, $35-$40K threshold, cap $22K | Income Share Agreement paused if income is below the threshold | Full-time & part-time, remote and in-person, 13-17 weeks |

| Hack Reactor / Galvanize | Software Engineering, Data Science | 10% income for 53 months, $60K threshold, 1.4x tuition max | Income Share Agreement paused if income is below the threshold | Full-time & part-time, online & in-person, ~12-24 weeks |

| Holberton School | Software Engineering | 17% income for 42 months, $40K threshold, cap $85K | 12% income for 48 months, $35-$40 threshold, cap $22K | Project-based, online & in-person, 9-12 months |

| Thinkful | Software Eng, Data Science, UX/UI | 15% income for 36-48 months, $40K threshold, cap $28K-$40K | Tuition refund if no job within 5 years | Full-time/Part-time, online, 5-6 months |

| Tech Elevator | Full-stack Engineering | 10% income for 48 months, $40K threshold, 1.5x tuition cap | Payments pause if income is below the threshold | Full-time, online & in-person, 14 weeks |

| Microverse | Full-stack Development | 15% income for 36 months, $1,300 deposit, $40K threshold | End-to-end remote with a job guarantee | Full-time, fully remote, 9 months |

| CareerFoundry | UX Design, Web Development, Data Analytics | 17.5% income for 24 months, $43K threshold, cap varies | Partial refund if no job in 6 months | Self-paced, online, 6-12 months |

| Lambda School | Data Science, Full-stack Web Development | 17% income for 24-48 months, $50K threshold, max $30-45K | Tuition refund/job guarantee | Remote, full-time, 6-9 months |

| V School | JavaScript, Python/Django, Front-end Web Development | Income Share Agreement, with initial deposit and income-share payments post-employment | Job guarantee or tuition refund terms (specific conditions vary) | Full-time, in-person & online; 12 weeks full-time |

In-Depth Program Highlights

Let’s take the time to carefully break down and explore some of the elements of the job placement program so that you have a clear and thorough understanding of exactly what to expect throughout the process and how each aspect will significantly benefit and support your overall career journey and professional growth.

App Academy

No upfront deposit is needed to get started. You will only pay 15% of your salary for a period of three years, and this payment begins only after you have successfully secured a job that pays $50,000 or more annually.

They offer a job guarantee: if you are unable to find employment within six months after completing the program, you will receive a full refund of your tuition. The program provides an intensive and comprehensive focus on software engineering, with both flexible full-time and part-time options available to suit your individual schedule and learning preferences.

Bloom Institute of Technology (BloomTech)

Offers comprehensive and advanced programs specializing in web3 development and data science. You can select from two different Income Share Agreement (ISA) options, each featuring distinct initial deposits and capped repayment limits tailored to your financial situation.

Experience the ultimate convenience of fully remote learning, allowing you to study from anywhere at any time. Alongside this flexibility, take advantage of our thoughtfully designed extended payment plans that are tailored to accommodate your unique financial situation and busy lifestyle, ensuring a seamless and stress-free learning journey.

General Assembly

The Income Share Agreement requires only a $250 initial deposit and a 10% share of your income. It covers a broad range of in-demand tech skills, such as data science, UX design, and more. Repayment starts only once your income reaches $40,000 or higher, and the payment period can extend up to 96 months, providing ample flexibility.

Thinkful

Provides a comprehensive living stipend option alongside an Income Share Agreement (ISA) to offer continuous financial support throughout the entire training period. Consistently achieves impressive job placement rates, approximately 85%, by using a mentorship-focused learning approach that emphasizes personalized guidance and skill development.

Payment amounts are capped to protect learners, and all payments are deferred if employment is not secured within a five-year timeframe, ensuring financial safety and peace of mind for participants.

Holberton School

Project-based learning that is extensively focused on developing and enhancing software engineering skills through practical, hands-on experience. The income share agreement is set at 17%, with a protective payment cap designed to safeguard your financial interests.

Additionally, Income Share Agreement payments will be paused if you have not secured a qualifying job after graduation, ensuring you are not burdened with payments during periods without relevant employment.

V School

V School has established a solid and well-earned reputation for its dedicated focus on teaching practical, job-ready skills that prepare students thoroughly for the workforce. The school provides students with the convenience and flexibility of choosing between online and in-person learning formats, catering to diverse learning preferences and schedules.

This approach makes it a compelling and reliable alternative to Lambda (BloomTech), especially when considering factors such as Income Share Agreements (ISAs) and job placement guarantees, which are important aspects for many prospective students seeking career-focused education.

In Summary

These programs combine comprehensive market-relevant skill training with innovative and flexible payment structures alongside strong job placement assurances. They are designed specifically to support individuals who are highly motivated to pivot their careers without taking on unnecessary risks or financial burdens.

By thoughtfully integrating these critical elements, the programs are able to effectively reduce significant financial barriers that often hinder individuals, while also providing a much safer, more accessible, and supportive pathway for those seeking to make important career transitions.

This comprehensive overview is carefully compiled based on data aggregated from a wide range of multiple authoritative and highly reputable sources that specialize in providing detailed insights about the leading and most prominent bootcamp offerings available in the year 2025.

Pros and Cons of Job Guarantee Programs with Income Share Agreement payments

Here is a comprehensive and detailed overview of the Pros and Cons of Job Guarantee Programs combined with Income Share Agreements (ISAs), incorporating valuable insights from a variety of expert sources as well as recent in-depth analyses and studies conducted on this topic:

Pros

- Lower Financial Risk: You only start repaying once you earn a job-level salary above a defined threshold (usually around $33K-$60K annually). This protects students from immediate debt pressure if they are unemployed or underemployed post-training. Payments can be paused or forgiven if income drops below the threshold.

- Motivational Alignment: Schools and investors have “skin in the game” to help students succeed because they benefit financially only when graduates earn enough to repay. This creates incentives for high-quality training, career support, and job placement efforts.

- Accessible to More Learners: Income Share Agreement payments often have fewer barriers than traditional loans, such as low or no minimum credit score requirements and no cosigner needed, making them accessible to learners who are financially constrained or have poor credit histories.

- Flexible and Affordable Payments: Since payments are a fixed percentage of income, they are easier to budget and remain affordable relative to your earnings. This income-based approach means repayments adjust naturally with changes in your financial situation.

- Supportive Career Services: Many job guarantee programs offer mentorship, career coaching, interview prep, and employer networks to maximize your chances of securing meaningful employment.

Cons

- Longer Overall Payment Duration: The total repayment period can extend up to several years (often 3-5 years), and because payments are proportional to income, you might pay back more than you would with a traditional upfront tuition payment or loan.

- Strict Eligibility and Conditions: Job guarantees often come with tight conditions, such as geographic restrictions, types of jobs qualifying, and active job search efforts. If these conditions aren’t met, you may lose the guarantee or still be obligated to repay.

- High Income Share Percentage: The income share you agree to pay (often 10% to 17%) can significantly affect your monthly cash flow post-employment, impacting your ability to save or invest in other areas.

- Potential to Pay More Than Traditional Tuition: Some Income Share Agreement payments have payment caps that are multiples of the tuition value (e.g., 1.4x to 2.5x tuition). High earners might end up paying substantially more overall compared to an upfront tuition payment.

- Lack of Regulatory Oversight: Income Share Agreement payments are usually private contractual agreements without consistent government regulations, which may limit consumer protections often found with federal student loans.

- Not Always Job-Quality Guaranteed: While programs promise job placement, the quality and fit of these jobs vary. The guarantee often focuses on any qualifying job above a salary threshold, not necessarily the “right” or preferred career opportunity, which can impact long-term career trajectory.

Income Share Agreements with Job Guarantees offer a highly appealing yet intricate option for financing education, especially for individuals seeking flexible payment plans combined with the assurance of employment assistance upon completion. This approach is particularly advantageous for those who prioritize manageable financial obligations during their studies and value the security of a job guarantee afterward.

However, it is crucial for prospective students to thoroughly comprehend the specific terms, conditions, and potential long-term financial commitments involved before deciding to enroll in such programs. Careful consideration and detailed understanding can help ensure that this financing option aligns well with their career goals and financial situation.

FAQs

What happens if I don’t make the minimum income threshold?

Most programs pause your Income Share Agreement payments if your income falls below the minimum threshold, commonly around $30,000 to $50,000 per year. During such periods, you do not owe payments, and these months may be added to the end of your payment term or extend the duration. This means that you only pay when earning enough to afford the payments, providing financial flexibility during unemployment or low-income periods.

Are job guarantees really risk-free?

Job guarantees reduce your financial risk by offering tuition refunds or deferred payments if you don’t find a qualifying job within a set timeframe. However, these guarantees usually have eligibility requirements like actively seeking employment, geographic limits, job type criteria, and deadlines. Failure to meet these conditions might void the guarantee. So, while they lower the risk, they are not completely risk-free.

Can I negotiate Income Share Agreement terms?

Income Share Agreement contracts are typically standardized and not negotiable, but some programs offer multiple Income Share Agreement options (different income shares, thresholds, or payment caps) so you can choose what works best for you. Flexibility may exist in selecting a deposit amount or opting for upfront payment discounts, but individual negotiation is rare.

Is an Income Share Agreement better than a loan?

It depends on your circumstances. Income Share Agreements eliminate upfront costs and adjust payments based on income, reducing financial strain if you don’t find a high-paying job immediately. However, total payments under an Income Share Agreement can exceed traditional loan repayment amounts. Loans have fixed payments that must be made regardless of income, but they may end sooner and have higher interest rates. Evaluate your career confidence, financial resilience, and program terms to decide.

\How do I choose the right program?

Consider your financial situation (can you afford deposits or upfront payments?), your career goals (which tech skills align with your interests?), the reputation and graduate outcomes of the program, detailed Income Share Agreement terms (income thresholds, income share percentage, payment caps, duration), and the job guarantee conditions. Reading reviews, comparing offers, and assessing support services like mentoring and career coaching will help you make an informed choice.

In Conclusion

For motivated career changers, recent graduates, and job seekers aiming to enter the booming tech industry, job guarantee programs with Income Share Agreements (ISAs) present a pioneering and accessible route to a rewarding career without the burden of upfront financial pressure.

This model uniquely aligns your success with the bootcamp’s incentive to get you hired, ensuring you are supported throughout your learning and job placement journey. Programs like

- App Academy

- Bloom Institute of Technology (BloomTech)

- General Assembly

- Thinkful

They all offer comprehensive training in high-demand tech fields—such as software engineering, data science, and UX/UI design—with robust financial safety nets. Their job guarantees and Income Share Agreements terms provide peace of mind, making career pivots more approachable with built-in risk reduction.

Remember, it is essential to carefully review each program’s terms—including the income share percentage, payment caps, job guarantee conditions, and program format—to select the option best suited to your financial situation and career goals.

As the tech world grows ever more competitive, choosing a bootcamp with a job guarantee and an Income Share Agreement can position you effectively for success, backed by quality education, strong support systems, and proven pathways to employment.

Discover more from Skill to Grow

Subscribe to get the latest posts sent to your email.