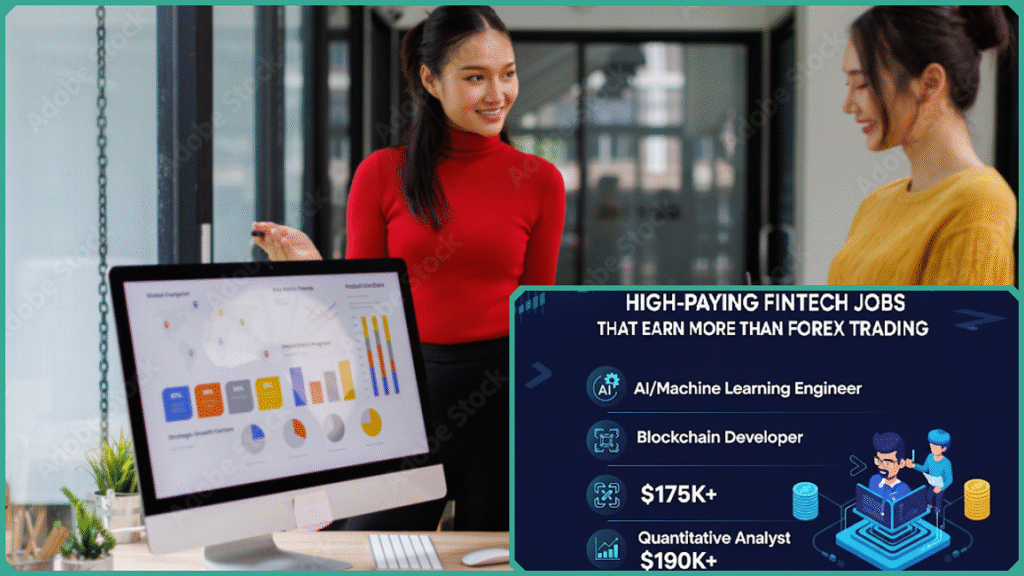

High-Paying FinTech Jobs That Earn More than Forex Trading

Estimated reading time: 19 minutes

For many individuals, the primary appeal of forex trading arises from the enticing promise of fast and significant profits that can be made within a relatively short period. The dynamic and ever-changing nature of currency trading attracts numerous beginners who are eager to break free from the traditional 9-to-5 routine and achieve a greater level of financial independence and flexibility.

However, it is important to recognize that the inherent high risks and extreme volatility present in forex trading often overshadow these enticing prospects, making it a challenging and potentially hazardous endeavor for many forex traders.

In today’s rapidly evolving financial environment, FinTech—the innovative combination of finance and advanced technology—has emerged as a highly dynamic and fast-growing field. This sector offers numerous rewarding and stable career opportunities that frequently exceed the income potential typically associated with forex trading.

As technology continues to transform financial services, professionals in FinTech find themselves at the forefront of groundbreaking developments, enjoying both financial benefits and long-term career stability.

This article is designed to educate and inform aspiring professionals, individuals considering a career change, and curious finance enthusiasts by shedding comprehensive light on the high-paying FinTech job opportunities that are available in today’s dynamic market.

It places a strong and important emphasis on carefully carving out a realistic and sustainable career path that effectively blends the dynamic and ever-evolving worlds of technology and finance. This approach ensures not only immediate opportunities but also long-term growth, stability, and highly rewarding prospects throughout one’s professional journey.

For those who might be tempted by the often speculative and unpredictable nature of forex trading, this guide thoughtfully reframes the conversation by presenting FinTech careers as much more dependable, innovative, and consistently profitable alternatives that can offer greater security and professional fulfillment over time.

Key Concepts: What Is FinTech and Why It Pays Well

Financial Technology, commonly known as FinTech, encompasses a wide range of companies and cutting-edge technologies that use advanced software and innovative methods to deliver a variety of financial services. The scope of FinTech is extensive and diverse, covering areas such as;

- Digital Banking

- Online Payment Systems

- Blockchain and Distributed Ledger Technologies

- Robo-advisors for Investment Management

- Algorithmic and High-Frequency Trading Platforms, and many other emerging financial innovations

This rapidly evolving sector thrives by harnessing the power of technology and vast amounts of data to fundamentally transform and improve traditional financial services, making them significantly more efficient, accessible to a broader audience, and highly customer-centric with user-friendly solutions designed to meet modern demands.

The rapidly rising prominence of FinTech has significantly increased the demand for professionals who possess a unique combination of finance expertise alongside advanced technology skills. This powerful synergy requires specialized roles that blend deep financial acumen with strong programming and coding proficiency, as well as data science capabilities and a thorough understanding of regulatory frameworks.

Because these complex and multifaceted skill sets are essential in today’s rapidly evolving financial technology landscape, FinTech jobs have become incredibly highly sought after by employers across various industries. Additionally, these positions often offer very competitive and attractive compensation packages that reflect the specialized expertise and value these professionals bring to their organizations.

Several important and compelling reasons explain why jobs in the FinTech industry generally offer higher-than-average salaries:

- Complex Skill Sets: The roles require a highly versatile and diverse mix of skills that span across multiple critical areas, including finance, advanced technology, comprehensive data analysis, and stringent compliance regulations. This unique combination of expertise makes finding qualified candidates exceptionally challenging, thereby increasing their value and demand significantly.

- High Impact: FinTech products have a direct and significant influence on large consumer bases as well as major financial markets worldwide, which makes the roles associated with these products strategically crucial and highly important within organizations. These positions not only shape the future of financial technology but also drive innovation and growth in the industry at large.

- Innovation-Driven: Rapid and continuous technological advances, along with frequent market disruptions within the FinTech industry, create a highly dynamic environment where companies must offer competitive salary premiums. These attractive compensation packages are essential to successfully attract and retain the most skilled and talented professionals who can drive innovation and maintain a competitive edge in this fast-evolving sector.

- Risk Mitigation: Unlike trading roles, which often involve high volatility and unpredictability in earnings, FinTech jobs typically provide employees with fixed, reliable salaries that ensure a steady income. In addition to these stable base salaries, many FinTech positions also offer performance-based bonuses, which create opportunities for income growth and financial scalability. This combination of fixed pay and potential for additional earnings makes FinTech jobs significantly more stable and secure compared to the fluctuating nature of trading jobs.

In stark contrast, income generated from forex trading is widely recognized as being extremely volatile and highly unpredictable. Apart from a small group of exceptionally skilled institutional traders or hedge fund professionals who possess substantial capital reserves and deep, specialized expertise, most independent retail traders often face steep and difficult learning curves, significant emotional stress, and considerable capital limitations.

These factors collectively hinder their ability to achieve consistent profitability over time. As we move through 2025, the forex trading landscape continues to be fiercely competitive and is heavily influenced by ongoing global economic shifts, rapid advancements in technology, and evolving regulatory frameworks. Despite these dynamic factors shaping the market, for the vast majority of retail traders, maintaining reliable and steady profits remains a significant and ongoing challenge.

Therefore, for individuals who are seeking a stable yet highly lucrative career pathway that effectively blends the dynamic fields of finance and technology, FinTech jobs present a particularly compelling and attractive alternative. These roles provide a much more reliable and consistent option compared to the often high-risk and unpredictable nature of forex trading, which can involve significant fluctuations and variable returns over time.

Current Trends and Developments in FinTech Careers

The FinTech sector continues to demonstrate remarkable resilience and rapid evolution throughout 2025, fueled by ongoing technological innovations and an ever-increasing market demand. This swift progression is clearly evident in the wide variety and substantial financial benefits of the most sought-after roles spanning the entire industry landscape.

Several of the leading and most influential careers that are shaping and defining this current wave include:

FinTech Product Manager

These skilled professionals play a crucial role in transforming innovative ideas into profitable and user-friendly digital financial products, such as advanced banking applications, AI-powered financial advisors, and secure payment solutions.

They act as the key coordinators between multiple teams, including technology developers, compliance officers, and customer experience specialists, ensuring that the products not only meet the latest regulatory requirements but also address and exceed evolving user needs and expectations.

The demand for talented product managers is particularly high among neobanks and payment startups, which are striving for rapid innovation and market disruption in the competitive financial technology landscape.

Blockchain Developer

The field of blockchain development has significantly expanded well beyond its initial focus on cryptocurrency startups and now plays a crucial role in many other industries, such as insurance, logistics, enterprise finance, and the rapidly growing sector of decentralized finance (DeFi).

Blockchain developers are responsible for creating and deploying smart contracts, designing and building comprehensive DeFi platforms, and integrating secure decentralized ledger technology to ensure transparency and immutability. They often work with specialized programming languages like Solidity and adhere to widely accepted standards such as ERC-20 to facilitate token creation and interoperability.

Due to the high demand and specialized expertise required, salaries for blockchain developers in major markets can reach impressive figures, sometimes as high as $190,000 per year, highlighting the significant value and premium placed on this highly sought-after skill set.

AI and Machine Learning Engineers

Artificial intelligence has become a fundamental pillar within the fintech industry, serving as a critical technology that underpins a wide range of applications such as fraud detection, predictive analytics, autonomous finance operations, and the creation of highly personalized financial products tailored to individual needs.

The demand for skilled engineers with expertise in programming languages like Python, frameworks such as TensorFlow, and specialized fields including natural language processing and MLOps is experiencing rapid growth.

Professionals with advanced AI knowledge are instrumental in enabling the hyper-personalization of financial services, enhancing risk management capabilities, and developing autonomous decision-making systems that operate efficiently and accurately in real-time environments.

Compliance and Regulatory Leaders

As the fintech industry continues to advance at a rapid pace, regulatory frameworks are constantly evolving to address emerging challenges and ensure greater transparency, enhanced consumer protection, and robust security across payments, cryptoassets, and open finance platforms.

Compliance officers who possess the expertise to navigate these complex and ever-changing regulations, along with strong skills in cybersecurity and risk management, have become essential and highly valued within organizations.

Their roles have expanded significantly, evolving from traditional functions often seen as mere cost centers to critical strategic leadership positions that influence the overall direction and success of their companies.

Cybersecurity Specialists

As digital payments, cryptoassets, and open finance solutions continue to grow rapidly, the demand for cybersecurity roles within the fintech sector has significantly increased. These specialists are primarily responsible for protecting sensitive consumer data, preventing various forms of fraud, and ensuring strict adherence to regulatory compliance standards.

Their expertise is crucial in safeguarding financial transactions and maintaining customer trust. In particular, proficiency in advanced digital identity verification methods and AI-driven fraud detection technologies is highly valued, as these tools help combat increasingly sophisticated and evolving cyber threats that target fintech platforms and services.

Summary of the Top High-Paying FinTech Jobs

| Job Title | Average U.S. Salary (2025) | Role Summary |

|---|---|---|

| FinTech Product Manager | $130,000 – $160,000 | Creates AI-driven financial products, including fraud detection, trading bots, and personalized financial advice. |

| Blockchain Developer | $120,000 – $160,000 | Builds secure decentralized finance (DeFi) platforms, smart contracts, working with blockchain tech like Ethereum. |

| Data Scientist | $100,000 – $140,000 | Analyzes consumer and transactional data to generate business insights, detect fraud, and personalize services. |

| FinTech Engineer | $110,000 – $145,000 | Designs software infrastructure for digital payments, crypto platforms, and investment algorithms. |

| Quantitative Analyst | $115,000 – $150,000 | Develops models and algorithms used in automated trading, risk management, and financial forecasting. |

| AI/Machine Learning Engineer | $120,000 – $160,000 | Creates AI-driven financial products including fraud detection, trading bots, and personalized financial advice. |

Market data clearly underscores this strong and sustained growth momentum: The UK fintech job market experienced an impressive 61% year-on-year increase in job vacancies during the early months of 2024, a surge largely fueled by a rising demand for development, engineering, and leadership positions focused on the intersection of traditional finance and emerging decentralized technologies.

This accelerated hiring trend is not isolated but rather extends widely across various key sectors, including payments, open banking, Buy Now Pay Later (BNPL) services, and Banking-as-a-Service platforms, reflecting the broad expansion and innovation occurring throughout the fintech ecosystem.

Fintech companies are also prioritizing the recruitment of leaders who can bridge digital and traditional finance, drive AI-powered product innovation, and adapt rapidly amid regulatory changes and geopolitical forces. In addition, talent demand is reshaping hiring dynamics with greater emphasis on employer branding, career growth opportunities, flexible work arrangements, and authentic employee engagement.

Overall, careers in the fintech industry today are distinguished by a diverse range of interdisciplinary skill requirements that span technology, finance, and data analysis. These roles are not only innovative in nature but also have a significant impact on transforming traditional financial services. Additionally, fintech positions often offer highly competitive salaries, underscoring the sector’s critical role as a major growth engine driving the evolution of global finance and economic development.

Salary Comparison: FinTech vs. Forex Trading

In the United States, the average annual salary for a fintech professional stands at approximately $123,495, with senior roles or specialized positions often commanding salaries above $180,000. These figures reflect the sector’s recognition of the complex expertise required and the strategic importance these roles hold in driving innovation and market disruption.

By contrast, independent forex traders—especially beginners or those with limited capital—face significant challenges in generating consistent profits. Their earnings are highly variable and influenced by multiple factors, including the amount of starting capital, individual skill level, prevailing market conditions, and their risk tolerance. Many retail traders incur losses or modest gains due to market volatility and the difficulty of sustaining profitable trading strategies over time.

On the other hand, professional traders working within financial institutions or hedge funds can earn substantially more, sometimes well into the six-figure range or beyond. However, these positions typically require a combination of vast starting capital, deep domain expertise, and often institutional backing—resources not accessible to most individual traders.

Additionally, forex trading income is inherently volatile and unpredictable, being closely tied to fluctuations in global currency markets. This contrasts sharply with fintech careers, which offer fixed salaries complemented by bonuses or incentives, providing greater financial stability and clear growth trajectories.

Consequently, fintech jobs emerge as more attractive options for individuals who prioritize long-term financial security, career advancement, and a structured professional path—elements less common in standalone forex trading careers.

In Summary

This comparative outlook clearly highlights fintech jobs as being ideally suited for individuals who are seeking a high-paying yet stable career that combines the best aspects of both finance and technology.

These roles offer a secure professional path that is far removed from the uncertainties, fluctuations, and risks commonly associated with forex trading. For those looking to build a dependable and lucrative career in the financial sector without exposing themselves to the high volatility of currency markets, fintech presents a compelling and attractive alternative.

Case Study: Transitioning From Forex Trading to FinTech

Jane’s journey from being a novice forex trader to becoming a highly successful fintech professional is a truly compelling and inspiring example of career transformation that is driven by strategic learning, continuous skill acquisition, and dedicated personal development.

Starting with $10,000 capital, Jane initially engaged in forex trading, facing the typical stresses and unpredictable earnings common in this high-risk financial activity. Frustrated by inconsistent profits and emotional strain, she researched alternative career paths that could leverage her interest in finance and technology while offering greater stability.

Jane decided to pursue a certification in data science—an in-demand fintech skill bridging quantitative analysis and technology. This credential equipped her with the technical expertise to handle big data, machine learning models, and financial analytics—core capabilities sought by fintech startups and established firms alike.

Within months, Jane secured a junior Data Scientist position at a growing fintech startup. This role involved analyzing large financial datasets, detecting trends, and developing predictive models aligned with the company’s digital financial products and services.

As Jane gained practical experience, her skills deepened, and her compensation grew. In just two years, her salary rose to over $110,000 annually. Moreover, she received performance bonuses and stock options, reflecting her contributions to the company’s success. Importantly, Jane now enjoys a steady income, clear career progression, and enhanced job security, while also benefiting from the opportunity to apply her trading insights in a broader, more impactful financial technology context.

Jane’s case exemplifies a typical career pivot within fintech: a fusion of finance knowledge and technology skills unlocking sustainable, high-paying professional possibilities. Her story underscores the considerable advantages of fintech jobs over the uncertainties of independent forex trading, illustrating a viable and rewarding alternative path for those looking to transition careers in 2025.

For career changers or beginners, the path includes understanding fintech domains, gaining relevant certifications, building hands-on experience, networking strategically, and selecting niches such as data science, blockchain development, or product management that match one’s skills and interests

Why Choose FinTech Over Forex Trading?

Choosing a career in FinTech instead of focusing solely on forex trading provides a variety of significant advantages that attract professionals who are looking for long-term stability, ongoing opportunities for growth, and the chance to make a meaningful and lasting impact in their field:

Stability and Predictability

While forex trading has the potential to generate sudden and occasionally substantial profits, it also comes with the significant risk of experiencing sharp and considerable losses. On the other hand, roles within the FinTech industry offer employees steady and reliable paychecks, comprehensive benefits packages, and well-defined career advancement opportunities.

This stable financial foundation enables professionals to plan their futures with much greater certainty and confidence, while also helping to minimize the emotional and psychological stress that is often linked to the unpredictable nature and volatility of trading activities.

Skill Development and Career Growth

FinTech careers place a strong emphasis on continuous learning and the mastery of highly sought-after, future-proof skills, including artificial intelligence, blockchain technologies, and big data analytics. These advanced skills are not only transferable across global markets but also strategically position professionals for rapid and significant career advancement within a fast-evolving and dynamic industry environment.

Unlike trading, which often relies heavily on personal capital investment and elements of luck or chance, FinTech jobs consistently reward dedicated skill acquisition, ongoing professional development, and a commitment to staying updated with technological innovations.

Work-Life Balance

Unlike the intensive and highly demanding nature of forex trading, which often requires continuous monitoring almost 24 hours a day and 5 days a week, many jobs within the FinTech industry provide significantly more flexible working hours and the possibility to work remotely from various locations.

This flexibility greatly facilitates a healthier and more manageable work-life balance, allowing employees to avoid the constant and intense pressure of having to track market fluctuations or manage trading risks directly on a minute-by-minute basis.

As a result, FinTech professionals now have a greater opportunity to thrive and excel within working environments that are more sustainable, balanced, and significantly less stressful. These improved conditions actively promote long-term career satisfaction, overall well-being, and a healthier work-life balance, allowing individuals to grow both personally and professionally over time.

Real Impact and Innovation

Working in the FinTech industry means actively contributing to the development and creation of innovative products and solutions that significantly enhance financial access, security, and operational efficiency for millions of people around the globe.

Professionals working in FinTech take on crucial roles in designing and implementing transformative technologies such as digital wallets, highly secure payment gateways, and AI-driven financial services. This field offers a deeply rewarding experience by providing a strong sense of purpose and tangible achievement, which stands in contrast to the often solitary and isolated nature of traditional trading activities.

Lower Risk

FinTech jobs remove the necessity of risking personal capital or encountering the high levels of financial unpredictability that are typically associated with trading activities. Employees in these roles benefit from stable and consistent compensation, which remains unaffected by the daily ups and downs of the market.

This financial stability significantly reduces stress and pressure, enabling workers to concentrate more effectively on honing their skills, executing tasks with precision, and driving innovation. Instead of being preoccupied with speculative profit-making, they can focus on delivering quality results and contributing to the growth and advancement of financial technology.

In Summary

For individuals who prioritize stability, consistent skill growth, maintaining balanced lifestyles, engaging in meaningful and impactful work, and seeking to minimize financial risk, careers in FinTech offer a significantly more attractive and sustainable choice when compared to the high-risk and often unpredictable world of forex trading.

FinTech jobs provide opportunities for long-term professional development within structured environments that support work-life balance, making them a preferable option for those aiming for steady career progression and personal well-being.

FAQs

Can beginners earn well in FinTech without prior finance experience?

Many entry-level FinTech jobs focus on technology skills such as coding, data analysis, or product management, where prior finance experience is not mandatory. Finance knowledge can be acquired on the job or via certifications and online courses, making FinTech accessible to those from diverse educational backgrounds.

Is forex trading more profitable than a FinTech job?

For most individuals, no. Forex trading profits are uncertain and heavily depend on skill, capital investment, and market conditions. Many retail traders struggle with consistency and risk significant losses. Conversely, FinTech jobs offer stable and often higher average earnings, with benefits and clear career progression, making them more reliable income sources.

Which FinTech skills are most sought after?

Among the top FinTech skills in demand are artificial intelligence, blockchain development, data science, software engineering, and product management. These skill sets drive innovation in digital payments, decentralized finance, AI-powered financial services, and regulatory technologies.

Can I combine a FinTech career with trading?

Many professionals maintain secure FinTech jobs while engaging in part-time or supplementary trading activities. This approach balances the stability of a salaried career with the potential upside of trading as a supplementary income, reducing overall financial risk.

How do I start a career in FinTech?

Begin by pursuing relevant education or certifications in finance, computer science, or data analytics. Practical experience through internships, projects, or boot camps is valuable. Networking within the FinTech community and staying abreast of industry trends enhances opportunities for entry and growth in this fast-evolving sector.

In Conclusion

Choosing between forex trading and a career in FinTech boils down to weighing speculative, high-risk income against stable, high-paying professional growth. Forex trading can be enticing with its promises of rapid gains and independence, but it comes with significant market volatility, emotional stress, and uncertain income.

In contrast, FinTech careers offer a sustainable and rewarding pathway to financial success, combining innovation and technology with finance in growing sectors such as digital banking, blockchain, AI-driven financial products, and secure payments. Professionals in fintech enjoy steady salaries, career progression, continuous skill development, and opportunities to create impactful financial solutions that improve lives globally.

For aspiring professionals, career changers, and students with interests in finance and technology, FinTech not only provides industry relevance but also a clearer route to personal fulfillment and long-term stability. Its demand for interdisciplinary skills ensures that those willing to learn and adapt can thrive, while contributing to shaping the future of financial services.

If captivated by the promise of rapid forex gains, pause to consider FinTech—a realm where expertise is consistently valued, innovations transform industries, and careers thrive with stability and growth. Choosing FinTech means embracing a powerful fusion of technology, finance, and sustainability for a rewarding career path.

This perspective aligns very well with the current market realities and the insights shared by industry professionals, strongly advocating fintech as a far superior choice for individuals who prioritize secure, well-paying, and deeply meaningful career paths in the year 2025 and the years beyond.

Discover more from Skill to Grow

Subscribe to get the latest posts sent to your email.