Deriv Trading Account TradingView Chart Settings for Success

Estimated reading time: 19 minutes

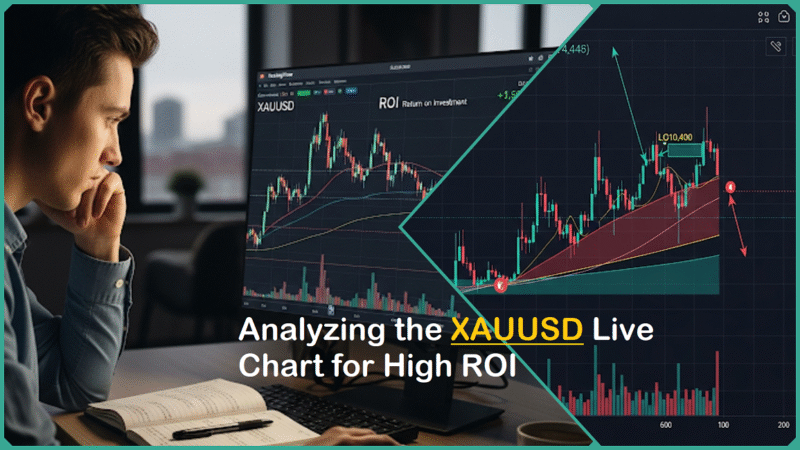

For traders using the Deriv platform, mastering the chart settings on TradingView integrated within Deriv can truly be a game-changer in enhancing trading performance. Whether you are new to Deriv or an experienced trader looking to explore and leverage TradingView’s advanced capabilities, having a solid understanding of how to configure and customize charts for optimal success is essential for making informed trading decisions and maximizing potential profits.

This integration significantly enhances the quality of trading decisions by providing a wide range of sophisticated and advanced tools, all accessible directly within the Deriv environment without the need to switch platforms or interrupt the trading workflow.

This detailed post thoroughly explores how to effectively set up and optimize TradingView charts specifically for use with a Deriv trading account. It is carefully designed to cater to both beginners who are just starting and veteran traders who are looking to enhance their strategies.

By carefully following the detailed guidance provided, you will be able to significantly enhance your trading performance and greatly boost your overall confidence when it comes to making well-informed and strategic trading decisions. This approach will empower you to navigate the markets more effectively and achieve better results.

Why TradingView on Deriv Matters

TradingView on Deriv matters because it significantly enhances the trading experience by bringing professional-grade charting tools and real-time market data directly within the Deriv X platform. This integration offers traders access to over 100 pre-built technical indicators, 17 customizable chart types—including popular options like candlesticks and Heikin Ashi—and more than 110 smart drawing tools such as Fibonacci retracements and trendlines.

These advanced features enable users to perform more detailed, comprehensive, and precise technical analysis across a broad and diverse range of financial assets. This includes popular markets such as forex, stocks, commodities, and cryptocurrencies, as well as specialized proprietary synthetic indices, allowing for in-depth market evaluation and informed decision-making.

The convenience of having powerful TradingView functionalities embedded directly into Deriv means traders can conduct sophisticated market analysis, manage their trades, and execute orders faster—all within a single seamless interface.

This integration is available on both desktop and mobile devices at no additional cost, aligning with Deriv’s commitment to providing accessible, value-driven trading solutions. It also supports demo and live accounts, allowing users to practice strategies risk-free before trading live.

Overall, TradingView on Deriv significantly empowers traders of all levels—whether they are complete beginners just starting or experienced professionals—by providing a comprehensive suite of advanced analytical tools.

These tools enable users to make more informed, efficient, and strategic trading decisions with greater confidence. Importantly, this powerful functionality is available directly within the platform, eliminating the need for relying on third-party software or purchasing additional subscriptions, thereby streamlining the entire trading experience.

Key Chart Settings Essentials for Deriv Trading Accounts on TradingView

Professional traders fully understand that their chart serves as their cockpit, the essential control center from which they navigate the markets. We are going to carefully break down the most critical chart settings available on TradingView for your Deriv trading account.

Our primary goal is to assist you in setting up a clean, highly powerful, and exceptionally efficient trading environment that is carefully designed and tailored specifically to enhance every aspect of your trading experience.

Our goal is to equip you with all the essential tools and the ideal Deriv trading account setup required to fully maximize your potential for success in the complex and dynamic world of trading. We are dedicated to ensuring that your trading environment is carefully designed and optimized to support the highest levels of performance and informed decision-making, helping you achieve your financial objectives effectively.

Selecting the Right Chart Type

Choosing the right chart type is essential because it significantly shapes and influences how price data is visually interpreted and understood by the viewer. The selection of an appropriate chart determines the clarity and effectiveness with which the data’s story is communicated.

- Candlestick Charts: These are the most widely used type of charts in financial trading, depicting the open, close, high, and low prices for each specified time period. They provide a comprehensive view of price movements, revealing intricate patterns and trends that are extremely valuable for traders at all skill levels, from beginners just starting to advanced professionals seeking deeper insights into market behavior.

- Heikin Ashi Charts: These charts effectively smooth out price fluctuations over time, making it significantly easier to identify and follow trends by reducing the amount of market noise and random price movements. They are especially ideal and highly beneficial for analyzing volatile markets where price swings are frequent and often erratic.

- Other Options: Renko charts are designed to concentrate exclusively on following the trend by effectively filtering out smaller, insignificant price movements, allowing traders to focus on the bigger picture. On the other hand, Line charts provide a straightforward visual representation by connecting the closing prices over a period, offering a clear and easy-to-understand overview of price trends without the distractions of intraday fluctuations.

Setting the Timeframe

Deriv TradingView offers comprehensive support for multiple timeframes, ranging from very short 1-minute increments to expansive monthly views that capture long-term trends. Beginners typically find it effective to start with 15-minute or 1-hour charts, as these provide a balanced perspective by reducing excessive market noise while still delivering sufficient information for making informed decisions.

Scalpers, who aim to execute many rapid trades, often prefer extremely short intervals such as 1-minute or 5-minute charts because these allow them to capitalize on quick market movements. On the other hand, long-term traders usually focus their analysis on daily or weekly charts, which help them identify and understand broader market trends and patterns that unfold over extended periods.

Adding and Configuring Popular Technical Indicators

Indicators generate essential and valuable key signals that help traders effectively anticipate and predict upcoming market movements and trends:

- Moving Averages (MA) are essential tools used to smooth out price data over a specific period, helping to clearly highlight underlying trends and identify dynamic levels of support and resistance within the market. By filtering out the noise from random price fluctuations, moving averages provide traders with a clearer perspective on the overall direction of price movements. Traders have the flexibility to choose between different types of moving averages, such as simple moving averages (SMA) or exponential moving averages (EMA), depending on their trading strategy and preferences. Additionally, they can customize the periods of the moving averages to better suit their analysis, whether short-term, medium-term, or long-term trends, making MAs highly versatile for various trading styles and market conditions.

- Relative Strength Index (RSI): This technical indicator measures the speed and magnitude of price movements over a specified period, helping to identify when an asset may be overbought or oversold. By analyzing these fluctuations, the RSI highlights potential reversal points in the market, signaling traders when a price correction or trend change might be imminent.

- MACD (Moving Average Convergence Divergence): This technical indicator tracks the momentum of a financial instrument by comparing the relationship between short-term and long-term moving averages. It helps traders identify changes in the strength, direction, and duration of a trend by analyzing the convergence or divergence of these moving averages over time.

Users on Deriv’s TradingView platform can effortlessly add these indicators and customize their parameters to perfectly align with their individual trading strategies and preferences. This flexibility allows traders to optimize their analysis and improve decision-making based on their unique approach to the markets.

Using Drawing Tools Effectively

Drawing tools provide the ability to perform a more detailed and nuanced technical analysis, allowing users to visually interpret and understand complex data trends and patterns with greater precision and clarity. These tools enhance the analytical process by facilitating the identification of key support and resistance levels, trend lines, and chart formations, which are essential components in making informed trading decisions.

- Trendlines: These are essential tools used in technical analysis that help traders and investors determine the direction and momentum of a market trend. By drawing lines that connect a series of price highs or lows over a specific period, trendlines provide a visual representation of the prevailing trend in the price movement. They can indicate whether the market is in an upward, downward, or sideways trend, assisting in making informed decisions about entry and exit points in trading strategies.

- Fibonacci Retracements: Use Fibonacci retracement levels to identify potential reversal points by carefully measuring the extent of price pullbacks within an ongoing trend. These levels help traders anticipate where the price might find support or resistance during a temporary retracement before continuing in the original trend direction.

- Horizontal Support and Resistance Lines: These lines emphasize crucial price levels where the market has historically shown significant reactions. They mark important zones where buying and selling pressures tend to intensify, often causing the price to pause, reverse, or consolidate. Traders closely watch these levels as they provide valuable insights into potential future market behavior based on past price action.

Deriv’s TradingView platform offers an extensive selection of more than 110 drawing tools, allowing users to create highly precise and detailed annotations on their charts. These annotations can be conveniently saved within the platform and revisited at any time, providing traders with a powerful way to track and analyze market movements over the long term.

Saving and Loading Chart Layouts

To enhance overall efficiency, Deriv’s TradingView platform offers the valuable feature of saving custom chart setups. After traders carefully configure various indicators, drawing tools, and other important settings to suit their preferences, they have the option to save these specific layouts under personalized names for easy identification.

Being able to quickly reload these saved layouts not only saves significant time but also guarantees consistent and reliable analysis across multiple trading sessions or different asset classes. This functionality proves especially beneficial for traders who manage several trading strategies simultaneously, allowing them to switch between setups seamlessly without losing their preferred configurations.

These essential key settings establish a strong and reliable foundation for traders who use Deriv accounts in conjunction with TradingView, allowing them to enjoy a highly customized, efficient, and deeply insightful trading experience that can significantly enhance their decision-making process and overall performance in the markets.

Advanced Tips and Pro Deriv Trading Account Settings for Better Analysis

Moving beyond the basics is essential for serious traders who want to elevate their skills and achieve better results. In this section, let’s dive deep into advanced settings and professional tips on TradingView that will significantly help you gain a deeper, more nuanced, and comprehensive understanding of market behavior.

These insights are designed to enhance your experience and effectiveness when trading with your Deriv trading account, allowing you to make more informed and strategic decisions in the dynamic world of financial markets.

Customizing Chart Appearance for Comfort and Clarity

Deriv’s TradingView integration offers extensive customization options for chart appearance, allowing traders to tailor the visual settings to their unique preferences. This flexibility helps in minimizing visual fatigue, especially during extended trading sessions where clear and comfortable chart viewing is crucial. Traders can adjust:

- Background color and themes play a significant role in user experience, with many users showing a strong preference for dark themes as they tend to cause less eye strain over extended periods of use. Dark themes not only reduce glare but also help in minimizing blue light exposure, which can contribute to eye fatigue, especially in low-light environments. Many people find that using a dark background with lighter text creates a more comfortable visual experience, allowing them to work or browse for longer durations without discomfort. Therefore, offering a variety of background color options and theme choices, including dark themes, can greatly enhance accessibility and overall satisfaction for a wide range of users.

- Grid and axis visibility options enhance clarity, allowing traders to focus more precisely on price movements without distractions. By adjusting these visual elements, users can create a cleaner, more streamlined chart view, making it easier to analyze trends and fluctuations in the market data.

- Candle colors used in charts to clearly and distinctly mark bullish (upward-moving) candles and bearish (downward-moving) candles are essential for quick visual analysis. Typically, bullish candles are represented by colors such as green or white, indicating that the closing price is higher than the opening price, which signals upward price movement. On the other hand, bearish candles are commonly shown in colors like red or black, indicating that the closing price is lower than the opening price, which signals downward price movement. Using contrasting colors helps traders and analysts easily differentiate between positive and negative market trends at a glance.

These tailored customizations significantly help reduce decision fatigue by making charts visually intuitive, clearer, and much easier to interpret quickly, which is an especially important advantage in fast-moving and constantly changing markets where every second counts.

Using Multiple Chart Windows & Layouts

Traders who actively monitor multiple assets or various timeframes gain significant advantages by opening multiple TradingView chart windows within the Deriv X platform. This functionality allows for enhanced analysis and better decision-making. The platform supports:

- Multi-chart layouts provide the powerful capability to view multiple charts simultaneously, enabling users to observe different asset classes or various timeframes all at once. This feature enhances the ability to analyze diverse market segments side by side, facilitating more comprehensive and efficient decision-making. By displaying several charts in a single interface, traders and analysts can easily compare trends, patterns, and price movements across different instruments or time intervals without the need to switch back and forth between screens. Such layouts are especially valuable for those who manage portfolios with multiple asset types or who require a detailed examination of market behavior over various periods, ultimately supporting a more informed and strategic approach to trading and investment.

- Splitting screens or utilizing multiple monitors is an effective strategy to significantly expand trading views, allowing traders to monitor various markets, charts, and data simultaneously. By increasing screen real estate, traders can keep an eye on several assets, news feeds, and trading platforms at once, enhancing their ability to make well-informed decisions quickly and efficiently. This setup is particularly beneficial for active traders who need to analyze multiple data points without constantly switching between tabs or windows.

This valuable feature significantly aids in keeping a detailed and organized track of various important aspects, such as correlations, precise entry points, and the ever-changing market conditions, effectively. By doing so, it empowers traders to make well-informed, timely, and diversified trading decisions that can enhance their overall trading performance and success.

Shortcuts and Order Management Integration

Advanced users frequently leverage a wide range of keyboard shortcuts available on Deriv’s TradingView charts to significantly speed up trade execution and streamline the process of adjusting orders. These shortcuts enable traders to perform actions more efficiently, reducing the time needed for manual input and allowing for quicker responses to market changes. Important capabilities provided by these shortcuts include:

- Execute quick buy and sell orders directly from the chart interface using customizable hotkeys designed to significantly reduce execution delays, allowing for faster and more efficient trading decisions. This streamlined process enhances your ability to respond swiftly to market changes without navigating away from the chart view.

- Setting stop loss and take profit orders directly on chart price levels allows for more efficient and precise risk management as well as effective profit booking strategies. By placing these orders visually on the chart, traders can better align their exit points with key price levels, ensuring that losses are minimized and gains are secured systematically. This approach enhances overall trading discipline and helps in maintaining a balanced and well-managed portfolio.

- Modifying or closing open trades instantly and directly from the chart allows for an exceptionally rapid and efficient response to sudden and unpredictable market changes. This capability enables traders to adapt their strategies quickly without navigating away from the visual data, ensuring timely decision-making in fast-moving market conditions.

Such seamless integration of analysis with order management significantly reduces the friction that often exists between decision-making and the execution of those decisions. This reduction in friction is especially crucial in highly volatile environments where market conditions can change rapidly and unpredictably.

In these fast-paced settings, even a delay of seconds can have a substantial impact on profitability, making the smooth coordination between analysis and order management essential for maintaining competitive advantage and optimizing financial outcomes.

Together, these advanced settings and powerful features available on TradingView within the Deriv platform empower traders to make smarter, faster, and more precise trading decisions. The ability to customize charts extensively, monitor multiple charts simultaneously, and execute orders seamlessly within the same interface truly distinguishes Deriv as a comprehensive trading platform.

This makes it an ideal choice for both novice traders who are just starting their journey and professional traders looking to enhance and elevate their trading strategies to achieve a competitive edge in the markets.

Latest Developments and Trends in Deriv TradingView Usage

In 2025, Deriv significantly enhanced its Deriv X platform by fully integrating TradingView charts, providing traders with powerful, professional-grade charting tools directly accessible within the platform.

This integration is available on both desktop and mobile devices, offering seamless access to advanced chart types, over 100 technical indicators, and numerous drawing tools for comprehensive market analysis. Importantly, traders can now execute trades directly from the TradingView charts on Deriv X, streamlining the process from analysis to order placement.

Real-time syncing of account balances, open positions, and trade data ensures users have up-to-date information without switching screens. Another key trend is the availability of TradingView on Deriv’s demo accounts, allowing traders to safely test and refine strategies with live market data before risking real funds, a practice highly favored for risk management.

The Deriv-TradingView integration focuses on delivering a smooth, all-in-one trading experience, offering free access to advanced charting without additional fees, which greatly benefits traders seeking precision and convenience. This move aligns with evolving market demands where data-driven decision-making and fast execution are crucial for success.

Moreover, while Deriv users enjoy TradingView’s rich charting ecosystem inside Deriv platforms like Deriv X and charts.deriv.com, it’s important to note that the integration is charting-focused rather than a full broker connection with TradingView itself — trades must still be executed via Deriv platforms.

Overall, these significant advancements clearly demonstrate Deriv’s strong commitment to leveraging the most cutting-edge and innovative technology available to consistently improve trader outcomes. By doing so, Deriv aims to empower traders to make well-informed, efficient, and strategic trading decisions within an increasingly dynamic and fast-paced market environment that constantly evolves.

FAQs

How do I access TradingView charts from my Deriv trading account?

Log in to your Deriv account, then navigate to the Trader’s Hub to access a variety of trading features. From there, either create a new Deriv X account or open an existing one to get started. Once your account is ready, launch the TradingView charts directly from the Tools menu, allowing you to begin customizing your charts right away with a wide range of options and settings.

Can I trade directly from TradingView charts on Deriv?

On the Deriv X platform, users have the capability to place and manage their trades directly from TradingView charts seamlessly and intuitively. This integration allows for a smooth connection between detailed market analysis and efficient order execution, enhancing the overall trading experience by combining powerful charting tools with instant trade management.

What chart types should beginners start with on TradingView with Deriv?

Beginners are strongly advised to start their trading journey with candlestick charts, as these provide a clear and detailed view of price action, allowing them to understand market movements more effectively. Once they become more comfortable and confident in reading these charts, they can then explore Heikin Ashi charts, which are particularly useful for better identifying and following trends over time. This gradual approach helps build a solid foundation before moving on to more advanced charting techniques.

Are TradingView charts and tools free to use on Deriv?

Deriv provides complete and unrestricted access to TradingView’s comprehensive charting tools, which include a wide range of popular indicators and advanced drawing tools. This valuable feature is available entirely free of charge to all users, whether they have a demo account or a live trading account, ensuring that everyone can benefit from professional-grade charting capabilities without any additional cost.

How can saved chart layouts improve my trading on Deriv?

Saved chart layouts store all your preferred technical indicators, custom drawings, and configuration settings, allowing you to quickly reload your personalized setups whenever you start a new trading session. This feature not only saves valuable time but also ensures that your analysis remains consistent and reliable across multiple sessions, helping you maintain a steady workflow and make informed trading decisions with ease.

In Conclusion

Optimizing TradingView chart settings within your Deriv trading account is a crucial move toward achieving trading success. By carefully selecting suitable chart types, integrating essential technical indicators, and mastering the use of drawing tools, traders can confidently analyze market movements and make precise trading decisions.

The ability to save and reload customized chart layouts further enhances efficiency, allowing traders to maintain consistency across sessions. The latest Deriv X platform’s seamless TradingView integration delivers advanced analytical tools while supporting direct trading from charts, real-time syncing, and access on both desktop and mobile devices.

Whether a beginner or an experienced trader, taking the time to configure TradingView charts on Deriv equips traders with clarity, precision, and a strategic edge. It is highly recommended to utilize demo accounts for practice and experimentation, allowing risk-free learning and refinement of setups before engaging in live trading.

In essence, investing effort in mastering the TradingView tools embedded in Deriv not only improves technical analysis but also builds confidence and enhances overall trading performance, aligning with the pursuit of profitable and informed trading outcomes.

Discover more from Skill to Grow

Subscribe to get the latest posts sent to your email.