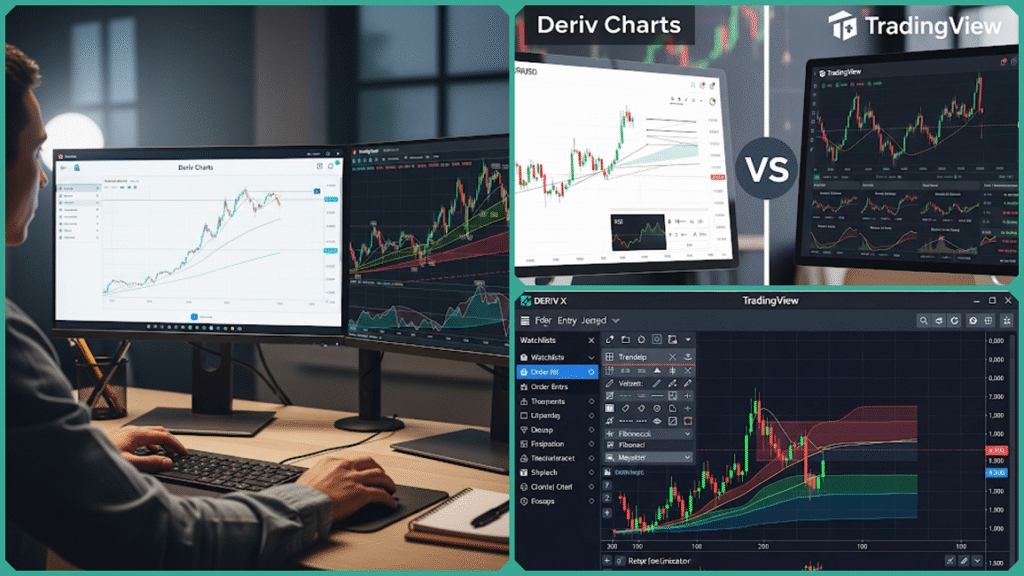

Deriv Charts vs TradingView: Which Trading Tool is the Best?

Estimated reading time: 21 minutes

For beginners and novice traders who are just starting to explore the exciting world of online trading, selecting the right charting platform can truly make a significant difference in their overall trading experience and success.

Among the many options available, two particularly popular choices stand out: the native Deriv Chart tools that come built-in with the Deriv platform itself, and the highly regarded, feature-rich TradingView charts, which are seamlessly integrated into Deriv’s advanced Deriv X platform.

Both options provide a range of unique advantages specifically designed to meet the diverse needs of different types of traders. Choosing the appropriate charting tool plays a crucial role in shaping how traders analyze market trends, interpret complex data, and make well-informed decisions. Ultimately, this choice significantly impacts their overall trading success and profitability in the competitive financial markets.

This comprehensive and detailed blog post thoroughly explores the various features, advantages, and potential trade-offs between Deriv Charts and TradingView. It is designed to assist traders at all experience levels—from complete beginners just starting to seasoned and professional users—in making an informed decision.

By carefully examining each platform’s unique tools, capabilities, and pricing options, this guide aims to help traders select the best charting solution that perfectly aligns with their individual needs, trading style, and budget constraints.

Key Concepts and Charting Platforms Explained

Navigating the world of online trading can be overwhelming, especially when you’re faced with a variety of tools. To make an informed choice, it’s essential to first grasp the core concepts of how markets are analyzed.

We’ll explain those fundamental ideas, from different chart types to key indicators. We’ll then break down what each platform, Deriv Charts and TradingView, offers and how they bring these concepts to life, so you can clearly see which tool is the best fit for you.

What is Deriv Chart?

Deriv Charts are the native, in-built charting tools embedded directly within the Deriv trading platform. These charts are designed with simplicity and integration in mind, catering especially to traders focusing on synthetic indices, forex, and commodities available on Deriv.

The core appeal of Deriv Charts lies in their straightforwardness—they offer essential technical analysis features that enable traders to quickly assess market trends and place trades without ever leaving the platform.

This ease of use is particularly advantageous for beginner traders or those who want to trade quickly without navigating multiple applications. Deriv Charts provide basic chart types like candlesticks, line, and bar charts, accompanied by standard technical indicators and drawing tools sufficient for everyday analysis.

While they might not have the breadth of advanced features that professional traders seek, their seamless integration with Deriv’s proprietary markets and absence of extra costs make them a reliable starting point for budding traders.

What is TradingView?

TradingView is a globally renowned, professional-grade charting and market analysis platform used by over 50 to 90 million traders worldwide (depending on the latest user statistics). It stands out for its vast range of tools and flexibility, offering over 100 technical indicators, 15+ chart types—including unique options such as Renko, Kagi, and Heikin-Ashi—and an extensive array of drawing tools that empower traders to perform highly detailed technical analysis.

More than just a charting tool, TradingView doubles as a social platform where traders share insights, strategies, and ideas. It covers diverse markets, including forex, stocks, cryptocurrencies, ETFs, and futures across more than 70 exchanges globally. This versatility supports traders who employ complex strategies and require in-depth market data and analyses beyond what simpler platforms offer.

TradingView is accessible both as a standalone web and mobile application with both free and paid subscription plans that unlock advanced charting features and data. For many experienced traders and analysts, TradingView is considered the industry standard for charting.

Deriv X TradingView Integration

Understanding the power of TradingView, Deriv has integrated TradingView directly into its Deriv X platform, creating a synergy between Deriv’s trading environment and TradingView’s advanced analytical tools. This move offers Deriv users the ability to trade directly on TradingView charts, combining the best of both worlds: Deriv’s exclusive asset offerings—most notably its proprietary synthetic indices such as Boom and Crash indices—and TradingView’s sophisticated charting interface.

This integration means traders no longer need to toggle between different platforms or subscribe separately to TradingView to access its superior charting capabilities. Traders on Deriv X can benefit from real-time synchronization of account balance, open positions, and order management, all within the TradingView charting workspace.

Features include access to over 100 technical indicators, over 110 smart drawing tools, multiple timeframes, custom watchlists, and the ability to save multiple chart layouts. For traders looking to deepen their technical analysis without leaving the ease of Deriv’s platform, the Deriv X TradingView integration provides a robust and seamless experience that enhances market analytics and decision-making.

Features Comparison: Deriv Charts vs TradingView

When deciding between Deriv Charts and TradingView, it is crucial to have a clear understanding of the core features and capabilities offered by each platform. This knowledge greatly assists traders in selecting the option that best aligns with their individual trading style, preferences, and level of experience.

Below is a detailed feature-by-feature comparison that highlights and evaluates how both platforms measure up against each other, helping traders make an informed choice suited to their specific needs.

| Feature | Deriv Charts | TradingView on Deriv X |

|---|---|---|

| Chart Types | Basic types: candlestick, line, bar | 15+ types, including candlestick, Renko, Kagi, Heikin-Ashi, and more, allowing multifaceted market visualization |

| Technical Indicators | Limited, covering essential indicators only | Extensive library boasting 100+ technical indicators and studies, supporting in-depth market analysis |

| Drawing Tools | Basic drawing tools such as trend lines and support/resistance | A professional set of 110+ smart drawing tools, allowing detailed chart annotations and technical strategies |

| Custom Layouts | No option for saving custom chart setups | Ability to save and load multiple custom chart layouts and templates for flexible analysis workflows |

| Trading Directly on the Chart | Yes, integrated trading interface | Yes, trade execution directly from TradingView charts within Deriv X for seamless analysis and order placement |

| Supported Markets | Deriv proprietary synthetic indices, forex, and commodities | Diverse markets including Forex, Stocks, ETFs, Cryptocurrencies, and Derived Indices exclusive to Deriv |

| Real-Time Data and Sync | Real-time market data within the Deriv platform | Real-time synchronization with Deriv account balances, positions, and order management for integrated trading |

| Accessibility | Fully integrated in the Deriv trading platform | Accessible via Deriv X platform or charts.deriv.com, available on desktop and mobile |

| Cost | Free with a Deriv account | Free access to basic TradingView features on Deriv X; standalone TradingView offers paid tiers for premium features |

| User Experience | Simple and beginner-friendly interface | Professional-grade, highly customizable environment suited for intermediate to advanced traders |

Additional Notes:

- The Deriv Charts provide an incredibly user-friendly and straightforward way for new traders to quickly and confidently jump into detailed chart-based analysis without any unnecessary complexity or confusion. This tool is especially perfect for traders who primarily focus on trading Deriv’s synthetic products and are looking for a seamless, fully integrated execution experience without the need to rely on any third-party platforms or external software.

- The TradingView integration on Deriv X significantly elevates the analytical capabilities available to traders by introducing an extensive range of advanced charting tools and providing access to a much broader market universe, all within the Deriv trading platform. This integration enhances the overall trading experience by allowing users to analyze market trends and price movements with greater precision and depth. In addition, it supports seamless multi-device access, enabling traders to switch effortlessly between their computers, tablets, and smartphones without losing their customized settings. The platform also offers personalized workspace setups, which are essential features that experienced traders frequently require to optimize their trading strategies and maintain efficient workflows across different devices.

Both platforms provide the capability of trading directly on charts, allowing users to execute trades without leaving the visual interface. However, TradingView offers a more advanced set of tools and a broader range of data coverage, which could make it worthwhile for users who are looking for more comprehensive technical analysis features.

This enhanced functionality could strongly justify considering making a switch or opting for an upgrade to TradingView, especially for traders and investors who are looking to deepen their market insights more thoroughly and significantly improve their overall trading strategies and decision-making processes.

Pros and Cons of Each Platform

Now that we’ve covered the foundational concepts, it’s time to get into the details that truly matter. Every trading tool, no matter how popular, has its strengths and weaknesses. In this section, we’ll provide a balanced and honest breakdown of the pros and cons of both Deriv Charts and TradingView.

This detailed side-by-side comparison is designed to assist you in thoroughly evaluating which platform’s features, capabilities, and limitations align more closely with your unique trading style and long-term financial goals.

Deriv Charts

- Pros:

- Seamless Integration: Fully embedded in the Deriv trading platform, facilitating smooth workflows without needing to switch between applications or sign into other services.

- Beginner-Friendly: Designed with simplicity, its intuitive and uncluttered interface suits novices who want quick, straightforward charting and trading.

- Cost-Effective: No additional fees or subscriptions are required; Deriv Charts come free with a Deriv account.

- Efficient for Synthetic Markets: Tailored to analyze Deriv’s proprietary synthetic indices, forex, and commodities, enabling quick technical assessments focused on these assets.

- Cons:

- Limited Advanced Features: Offers fewer chart types and technical indicators compared to professional charting platforms, which might restrict detailed market analysis.

- Basic Drawing Tools: Drawing features are minimal, supporting only simple trend lines and support/resistance markings, limiting sophisticated technical strategies.

- Not Ideal for Experts: Traders demanding complex analysis tools or multi-market versatility may find Deriv Charts insufficient.

TradingView on Deriv X

- Pros:

- Comprehensive Toolset: Access to one of the industry’s richest selections of over 100 technical indicators and more than 110 smart drawing tools for advanced market analysis.

- Customizable: Multiple chart types, templates, and the ability to save custom layouts enhance tailored strategy development and workflow efficiency.

- Direct Trading on Charts: Enables order placement directly from TradingView charts within Deriv X, blending analytical power with execution convenience.

- Seamless Account Sync: Trades, balances, and open positions sync in real time between Deriv X and TradingView charts, keeping all data unified.

- Community Insights: Leverages TradingView’s global trader community for sharing ideas, strategies, and market sentiment.

- Broader Market Access: Supports Forex, stocks, ETFs, cryptocurrencies, and synthetic indices, aiding diversified trading approaches.

- Cons:

- Steeper Learning Curve: The richness of features can be overwhelming for absolute beginners starting their trading journey.

- Paid Subscription Necessity (Standalone): While free on Deriv X, full TradingView features in the standalone platform require paid plans for advanced indicators and an ad-free experience.

- Separate Ecosystem: The TradingView charts integrated on Deriv are not fully connected with standalone TradingView accounts — no Pine Script automation or external indicator access is available.

This balanced perspective helps traders gain a clearer understanding that Deriv Charts primarily emphasize accessibility and the essential core features tailored specifically for Deriv’s proprietary markets, making them an excellent choice for newcomers and traders who are mindful of their budgets.

On the other hand, TradingView on Deriv X stands out by offering greater depth, enhanced flexibility, and a comprehensive set of powerful tools designed to meet the needs of traders who wish to advance their technical analysis capabilities and explore a much broader range of assets.

However, this feature comes with a certain level of complexity and may involve potential subscription considerations, particularly if it is accessed independently or separately from the main Deriv platform. Users should be aware of these factors before proceeding.

Deriv Charts vs TradingView: Current Trends and Developments

One of the most significant recent advancements in the trading platform landscape is Deriv’s integration of TradingView directly into its Deriv X platform. This strategic move has revolutionized the way traders analyze and execute trades on Deriv, especially in the synthetic indices market, which includes popular instruments like Boom and Crash indices.

Previously, traders primarily relied on MetaTrader 5 (MT5) for charting on Deriv—a platform known to offer only basic charting capabilities and limited customization. The new TradingView integration brings a professional-grade charting experience directly to Deriv’s environment, embedding advanced features such as over 100 pre-built indicators, 17 customizable chart types, and 110+ smart drawing tools.

These advanced tools empower traders to conduct significantly more nuanced and detailed technical analysis, all without the need to leave the comprehensive Deriv ecosystem. By integrating these resources directly within the platform, traders gain the ability to analyze market trends and make informed decisions more efficiently and effectively.

Beyond enhanced technical tools, the integration offers usability improvements through multiple timeframes, the ability to save and load custom chart layouts, real-time market data for a broad range of assets (forex, stocks, commodities, cryptocurrencies, ETFs, and derived indices), and seamless trade execution right on the TradingView charts.

This unified approach eliminates the need for constantly switching between different platforms or juggling multiple separate applications, which in the past frequently disrupted and slowed down workflows. By integrating everything into a single seamless system, users can now maintain their focus and efficiency without the once common interruptions.

For beginners, Deriv Charts remain an accessible entry point, providing straightforward charting directly on the Deriv platform with minimal complexity. Yet, as traders gain experience or seek deeper analytical capabilities, they can effortlessly transition to TradingView charts within Deriv X, benefiting from its rich tools without abandoning the Deriv interface.

This innovative and forward-thinking design promotes a truly seamless and integrated hybrid user experience that actively supports and encourages continuous growth and development. It achieves all of this while carefully ensuring that traders are never forced to leave, abandon, or switch away from their primary and preferred trading platform at any point in their trading journey.

In Summary

Deriv’s integration with TradingView exemplifies a significant and growing trend in the financial industry toward unifying trading and charting platforms into a seamless experience. This development greatly enhances a trader’s analytical capabilities by combining powerful charting tools with streamlined trade execution in one place. It clearly demonstrates

Deriv demonstrates a strong and unwavering commitment to providing cutting-edge technology solutions that effectively cater to the diverse needs of a wide range of users, including both novice traders who are just beginning their trading journey and advanced traders who demand highly sophisticated and feature-rich tools.

This dedication ensures that every trader, regardless of their experience level, can access the resources and functionalities necessary to succeed in the dynamic trading environment. By making these advanced market analysis tools widely accessible to a broad audience, Deriv is actively fostering an environment where more informed and strategic trading decisions can be made with confidence and ease.

Deriv Charts vs TradingView: Who Should Use Which?

Choosing the right charting platform depends largely on a trader’s experience level, individual trading goals, and specific need for in-depth analytical tools. Making the best choice requires understanding these factors clearly.

Below are carefully tailored recommendations designed to help different user groups find the most suitable charting platform for their unique requirements and preferences:

Beginner and Novice Traders

Start with Deriv Charts. The native charting tools on this platform are specifically designed with simplicity and ease of use in mind, making them especially suitable for individuals who are just starting their trading journey and may not yet be familiar with more complex charting software.

Deriv Charts provide coverage of basic trend analysis as well as essential technical studies, offering enough functionality to support learning and decision-making without overwhelming new users with unnecessary complexity or advanced features.

Furthermore, accessing these charts does not require any additional account setup or subscription fees, which makes it a highly budget-friendly and accessible option for beginners who want to learn the fundamentals and experiment with trading strategies in a straightforward and hassle-free manner.

Existing Deriv Users Eyeing More Power

As your trading skills continue to grow and develop, upgrading to TradingView on Deriv X provides a wide range of enhanced capabilities designed to help you deepen your market analysis even further.

With access to an impressive collection of over 100 technical indicators, more than 110 drawing tools, a variety of multiple chart types, and the convenient ability to save your own custom layouts, this seamless integration supports the development of much more sophisticated and refined trading strategies.

Perhaps best of all, this powerful and comprehensive analytical environment is available completely free of charge when you use Deriv X, making it a natural, accessible, and highly attractive next step for Deriv users who want to explore more advanced features and tools without ever needing to leave the platform.

TradingView Users Exploring New Brokers

For those who are already familiar and comfortable with TradingView’s highly advanced and sophisticated charting tools and are interested in exploring new brokers, Deriv X with TradingView integration presents an outstanding and compelling choice.

It effectively combines TradingView’s renowned charting excellence and user-friendly interface with Deriv’s distinctive synthetic 24/7 markets, including unique options like Boom, Crash, and Volatility indices—assets that are rarely found or offered on other trading platforms.

This powerful combination allows TradingView users to continue enjoying their well-known and trusted charting experience while also gaining access to new, exciting, and exclusive markets available only through Deriv, broadening their trading opportunities significantly.

Budget-Conscious Traders

Both Deriv Charts and TradingView on Deriv X are entirely free to use within the Deriv platform, offering a significant advantage by eliminating any additional expenses. This approach effectively levels the playing field for all traders, especially those who might be worried about facing extra costs or fees associated with advanced charting tools.

By providing these powerful resources at no cost, Deriv ensures that every trader has equal access to high-quality analytical tools, enhancing their trading experience and decision-making capabilities without financial barriers.

Although the standalone version of TradingView offers premium paid subscription plans that unlock a wider array of advanced features — such as the ability to apply multiple indicators per chart, access to more sophisticated tools, and an ad-free experience — the integrated TradingView available on Deriv X provides a comprehensive and robust free toolkit.

This toolkit is more than sufficient to meet the needs of most traders without requiring any additional expenses or fees. As a result, Deriv’s integrated TradingView option becomes a highly practical and attractive choice for traders who want access to premium-quality charting features without having to pay extra or upgrade to a premium plan.

In Summary

This detailed user-focused breakdown is specifically designed to help readers effectively identify the most suitable charting platform that aligns perfectly with their individual skill level, unique trading preferences, and available budget.

By offering this thorough and detailed guidance, it ultimately empowers users to make well-informed, thoughtful, and confident decisions that are carefully tailored and specifically designed to meet their individual, unique, and distinct needs within the complex trading environment.

FAQs

Can I trade directly on TradingView charts within Deriv?

With a Deriv X account, you can place trades directly from TradingView charts without any hassle. This powerful integration enables a seamless combination of advanced technical analysis tools with immediate order execution, all within a single user-friendly platform.

By bringing these features together, it significantly enhances your trading efficiency and convenience, allowing you to make well-informed decisions and execute your trades swiftly in one cohesive environment.

Is TradingView free on Deriv?

The TradingView charts and tools integrated into Deriv X are completely free to use at any time. Traders gain access to a wide range of technical indicators, numerous drawing tools, and several different types of charts without having to pay any extra subscription fees or hidden charges while trading on the Deriv platform.

This feature enables users to take full advantage of the advanced charting capabilities available to them, allowing for a more comprehensive and detailed analysis to significantly enhance their trading strategies, all without the concern of incurring any additional costs or hidden fees.

How do I switch between Deriv charts and TradingView?

To switch between different charting options on Deriv, the first step is to log in to your account on the Deriv platform and then open the Deriv X application. Once you are inside Deriv X, navigate to the top of the screen and click on the “Tools” menu. From the dropdown list, select the “TradingView” option, which will grant you access to the advanced charts featuring more sophisticated technical analysis tools and indicators.

If you prefer to use the native Deriv Charts instead, you can do so by utilizing the standard trading interface that is available outside of the Deriv X environment, allowing you to choose the charting experience that best suits your trading style and preferences.

Are Deriv Charts suitable for experienced traders?

Deriv Charts provide essential tools designed for basic technical analysis, making them highly suitable for beginners or traders who primarily focus on Deriv’s synthetic markets. These charts offer straightforward features that help users get started with analyzing market trends without overwhelming complexity.

However, for more experienced traders who require advanced features, a wide range of technical indicators, and highly flexible charting options, TradingView on Deriv X is a far more appropriate choice. It caters to professionals by delivering a comprehensive suite of tools that support in-depth market analysis and more sophisticated trading strategies.

Can I save custom chart layouts on Deriv Chart or TradingView on Deriv?

Only TradingView on Deriv X supports the ability to save and manage multiple custom chart layouts, making it an essential tool for traders. This advanced feature is incredibly important for traders who develop and apply a variety of different trading strategies over time.

It allows them to quickly switch between their various saved setups, enabling faster and more efficient analysis and execution of trades. Having the capability to manage multiple chart layouts helps traders stay organized and responsive in dynamic market conditions.

In Conclusion

Choosing between Deriv Charts and TradingView depends mainly on the trader’s experience level, analysis needs, and trading goals. Deriv Charts offer a streamlined, beginner-friendly platform perfect for novices looking for simplicity with no extra costs. On the other hand, TradingView on Deriv X targets traders who seek a robust, professional-grade charting experience backed by an extensive suite of technical tools, saving options, and market coverage.

For traders starting or those focused solely on Deriv’s synthetic indices, Deriv Charts are an effective and accessible choice. However, as skills and analytical needs evolve, upgrading to TradingView on Deriv X is a natural step, providing a powerful environment combining Deriv’s trading assets with TradingView’s charting excellence—all accessible at no additional cost on Deriv.

Traders who are interested in exploring opportunities beyond the range of markets offered by Deriv might want to consider investing in standalone TradingView subscriptions. These subscriptions provide access to a much broader spectrum of market data across various financial instruments, along with a variety of premium features designed to enhance the trading experience.

By opting for TradingView, traders can benefit from advanced charting tools, real-time data feeds, and customizable alerts, all of which can contribute to more informed and strategic trading decisions. This expanded access and enhanced functionality can be especially valuable for those looking to diversify their trading portfolios and stay ahead in dynamic markets.

Ultimately, the best choice not only empowers traders to make better and more informed market decisions but also aligns perfectly with their specific budget constraints. Additionally, it provides crucial support throughout the trader’s ongoing journey in mastering the complexities of online markets, helping them grow and succeed over time.

Discover more from Skill to Grow

Subscribe to get the latest posts sent to your email.