Advanced TradingView Charts for Easy Deriv Asset Analysis

Estimated reading time: 20 minutes

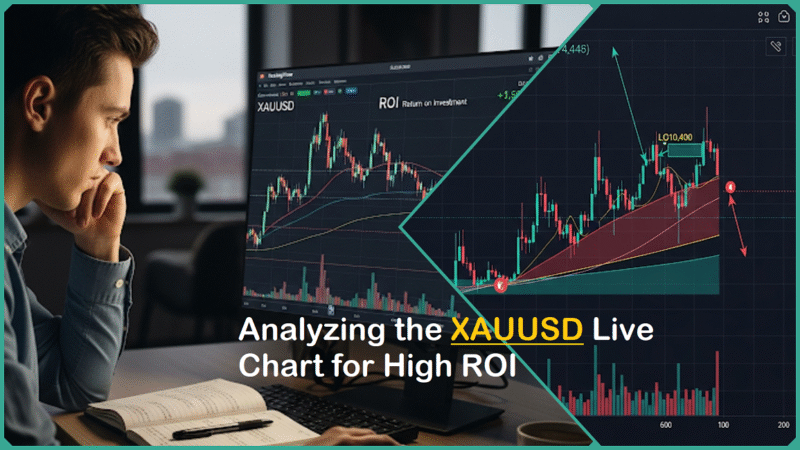

The ability to analyze assets quickly and effectively is crucial for achieving sustained success in the fast-evolving and highly competitive world of derivatives trading. For intermediate to advanced traders on Deriv, skillfully leveraging powerful and sophisticated charting tools can make all the difference between making profitable trading decisions and missing out on valuable market opportunities.

TradingView, widely recognized as a leading charting and social network platform designed specifically for traders, has successfully integrated its highly advanced and comprehensive charting tools with Deriv’s native trading platform. This integration has resulted in the creation of a seamless and user-friendly environment that is meticulously optimized to support in-depth and detailed market analysis for traders of all experience levels.

This article delves deeply into how the advanced TradingView charts significantly simplify and greatly enhance the process of asset analysis on the Deriv platform, providing traders with powerful tools and insights. By using these sophisticated charting features, traders are empowered to make well-informed, strategic decisions that can improve their trading outcomes and overall success.

Why Advanced TradingView Charts Matter for Deriv Traders

Advanced TradingView charts hold immense importance for Deriv traders because they effectively transform complex and often overwhelming market data into clear, precise, and actionable insights. This transformation significantly enhances traders’ analytical capabilities, going far beyond what Deriv’s native charting tools can offer on their own.

Deriv, being a global platform specializing in CFDs and various derivatives, provides access to a wide array of over 300 financial instruments. These include popular categories such as forex, commodities, stocks, and cryptocurrencies, as well as unique synthetic indices that are exclusive to the platform. Despite this broad offering, the default charting solutions provided by Deriv are relatively basic and lack the depth required for advanced market analysis.

By integrating TradingView’s sophisticated and feature-rich charts directly within Deriv’s trading ecosystem, users experience a remarkable upgrade in both the sophistication of market analysis and the overall usability of the platform. This integration empowers traders with enhanced tools to make more informed and strategic trading decisions.

Here are several important reasons why this issue truly matters and deserves careful consideration:

- Wide Range of Technical Indicators: TradingView provides over 100 built-in technical indicators, including popular momentum oscillators like RSI and MACD, volatility measures like Bollinger Bands, trend-following tools such as Moving Averages, and community-created custom scripts. This diversity allows traders to analyze market conditions from multiple perspectives, helping to identify trends, reversals, and key entry/exit points more accurately than with basic charts.

- Multiple Chart Types for Nuanced Analysis: Beyond the standard candlestick chart, TradingView supports various specialized chart types like Renko, Kagi, and Point & Figure charts. These alternative visuals reduce noise and focus on price action trends and reversals, which is particularly useful in volatile markets such as Deriv’s synthetic indices like Boom and Crash.

- Extensive Drawing Tools: Hundreds of drawing and annotation features aid traders in marking trendlines, support and resistance zones, Fibonacci retracements, pitchforks, and cycle analyses. These visual aids enhance pattern recognition and technical setups, facilitating quicker and more confident decision-making.

- Real-Time Market Data and Synchronization: The charts connect live with Deriv’s trading accounts, offering real-time price updates without delay. This synchronization reduces latency between analysis and action, a crucial advantage in derivatives trading where seconds can make a difference.

- Integrated Trading Workflow: On Deriv’s Deriv X platform, the TradingView interface allows users to perform market analysis and place trades directly from the charts, managing orders visually via stop-loss and take-profit tools. This seamless workflow eliminates the need to toggle between multiple platforms, thereby streamlining the trading process.

This advanced analytical toolkit has been specifically designed to tackle a wide range of common challenges faced by traders on Deriv. These challenges include

- The difficulty of identifying clear and reliable trends amidst the constant market noise

- The necessity for sophisticated and robust indicators to effectively confirm trade setups

- The ongoing effort to improve accuracy when timing trades

- The complexity involved in managing multiple strategies and analyses simultaneously

By providing enhanced visual clarity and a highly intuitive, user-friendly interface, this toolkit promotes better trading discipline and enables traders to react more quickly and confidently, both of which are essential factors that contribute significantly to achieving consistent trading success.

In summary

TradingView charts integrated within Deriv significantly enhance the analytical capabilities available to traders by offering professional-grade tools specifically designed for derivatives trading. This seamless integration combines powerful functionality with an intuitive, user-friendly design, enabling traders of various skill levels — from intermediate users to advanced professionals and those aiming to gain a technological advantage — to conduct thorough and more efficient asset analysis.

As a direct result of this enhanced capability, traders find themselves significantly better equipped to make well-informed and carefully considered strategic decisions. These improved decision-making abilities can ultimately lead to not only increased profitability but also a wide range of improved trading outcomes, allowing traders to achieve greater success in their financial endeavors.

Key Concepts and Features of TradingView Charts on Deriv

Understanding the fundamental key concepts and essential features of TradingView charts available on Deriv is crucial to fully harness their complete potential for efficient and effective asset analysis as well as strategic trading.

TradingView, which is seamlessly integrated directly into Deriv’s platform—most notably within Deriv X—provides a highly comprehensive, fully customizable, and real-time interactive charting experience specifically designed and tailored for derivative markets.

Here’s a comprehensive and detailed breakdown:

Chart Types

TradingView offers support for a total of 17 distinct chart types, providing traders with a wide range of options to visualize asset price movements in ways that best fit their trading strategies and adapt to various market conditions.

This extensive selection ensures that users can analyze data using the format that most effectively highlights trends, patterns, and key indicators. Among the most widely used and popular chart types available on TradingView are:

- Candlestick charts: The most commonly used, they vividly display open, high, low, and close prices, reflecting market sentiment and price momentum.

- Renko and Kagi charts: These charting styles filter out market noise and focus on clear price trends, making them ideal for volatile synthetic indices like Deriv’s Volatility 75.

- Point & Figure: Focuses solely on price movements without the time factor, useful for identifying support and resistance.

- Heikin Ashi: Smoothes price data to identify trends more clearly.

Choosing the most appropriate chart type is essential as it aligns your technical analysis perfectly with your unique trading style and the specific behavior of the asset you are examining. This careful selection significantly enhances the accuracy of your predictions and provides deeper, more valuable insights into market trends and movements.

Technical Indicators

TradingView charts available on Deriv come preloaded with an extensive selection of over 100 built-in technical indicators. These indicators are specifically designed to help traders effectively measure various market factors such as momentum, volatility, trend strength, and potential reversal points.

This comprehensive suite of tools allows users to analyze market conditions more thoroughly and make more informed trading decisions based on detailed technical insights.

- Examples include Moving Averages (MA), which smooth price data to highlight trend direction, Relative Strength Index (RSI) for momentum measurement, MACD for trend-following and momentum, and Bollinger Bands indicating volatility boundaries.

- Traders can apply multiple indicators simultaneously for layered insights or explore custom community scripts to tailor strategies.

These indicators assist Deriv traders in identifying optimal entry and exit signals with significantly improved precision by thoroughly analyzing the fundamental market dynamics that influence price movements.

Drawing and Annotation Tools

TradingView on Deriv provides users with access to hundreds of advanced and intelligent drawing tools, designed to allow traders to annotate their charts with great precision and detail. These tools significantly enhance the process of technical analysis by enabling more accurate identification of trends, patterns, and key market levels, which can ultimately improve trading decisions and strategies.

- Trendlines: Key for identifying support and resistance levels, visualizing price channels, and confirming breakout or breakdown points.

- Fibonacci Retracements: Aid in spotting potential reversal zones and price targets by measuring retracement levels derived from price swings.

- Channels and pitchforks: Useful for defining price ranges and trend direction.

- Pattern recognition tools: Assist in spotting classical technical setups such as double tops, head and shoulders, or wedge patterns.

For example, applying trendlines on the Volatility 75 Index can significantly assist traders in assessing and predicting when the price is likely to break out or reverse its current direction. This technique enhances the precision of entry timing when dealing with derivatives that are particularly sensitive to fluctuations in market volatility. By carefully analyzing these trendlines, traders can make more informed decisions, potentially improving their overall trading performance and risk management strategies.

Real-Time Synchronization and Direct Trading

One of the most powerful and impressive features of TradingView charts on Deriv X is the seamless real-time synchronization with your trading account, allowing you to experience up-to-the-second updates and detailed insights:

- Traders can place trades directly from the chart interface, streamlining the workflow.

- It supports order management, including visual placement of stop-loss and take-profit orders on the chart itself, increasing precision and control.

- You get instant updates on open trades, account balances, and order statuses, eliminating the need to toggle between separate platforms.

This integration significantly reduces the lag time between analysis and execution, providing a crucial advantage in derivatives trading where market conditions have the potential to change very rapidly and unexpectedly. By minimizing delays, traders can respond more swiftly to market fluctuations, improving their ability to capitalize on opportunities and manage risks effectively in a fast-paced trading environment.

Additional Features to Highlight

- Multiple Chart Layouts: Traders have the ability to open and customize multiple charts on a single screen, allowing them to monitor various assets or different timeframes at the same time. This feature provides enhanced flexibility and efficiency, enabling traders to keep track of several market movements simultaneously without switching between tabs or windows.

- Flexible Timeframes: Charting intervals are available across a broad spectrum, ranging from mere seconds to comprehensive monthly views. This versatility supports a wide variety of trading approaches, including quick scalping techniques, active day trading sessions, and longer-term investment strategies designed for sustained growth.

- Custom Alerts and Watchlists: Easily set personalized alerts based on specific indicator levels or significant price events directly on your TradingView charts. This feature allows you to stay informed and react promptly to market changes by receiving notifications tailored to your trading strategy and preferences.

Summary of the Key Concepts and Features of TradingView Charts on Deriv

| Feature | Description |

|---|---|

| Chart Types | 17 types including candlestick, Renko, Kagi, Point & Figure, Heikin Ashi |

| Technical Indicators | 100+ built-in indicators such as MA, RSI, MACD, Bollinger Bands, and custom scripts |

| Drawing Tools | 110+ tools for trendlines, Fibonacci retracements, channels, and pattern recognition |

| Real-Time Integration | Live synchronization with Deriv X trading account for direct order placement and trade management |

| Multi-Chart Layouts | View and customize multiple charts on one screen |

| Alerts & Notifications | Set up custom alerts on price and indicator conditions |

By thoroughly mastering these advanced TradingView features available on Deriv, traders can significantly elevate their asset analysis capabilities using precision tools specifically designed and adapted for the fast-paced and ever-changing derivatives market.

This comprehensive understanding and utilization of the platform’s functionalities ultimately lead to improved trade timing and enhanced overall strategy effectiveness, allowing traders to make more informed decisions and increase their potential for success in the competitive trading environment.

Current Trends and Developments

Recent developments highlight a strong trend of seamless integration and customization between TradingView and Deriv, substantially enhancing the trading experience for over 3 million users worldwide. This collaboration embeds TradingView’s advanced charting capabilities directly into Deriv’s native platform (notably Deriv X), eliminating the need for users to switch back and forth between platforms.

Traders enjoy quick access to sophisticated chart layouts and personalized watchlists—all tailored to their unique trading preferences. Deriv users benefit from 24/7 access to global market data streams, covering forex, stocks, cryptocurrencies, and synthetic indices, enabling continuous and informed market analysis regardless of timezone or asset class.

The integration supports a broad spectrum of 300+ trading instruments on Deriv, empowering users with professional-grade tools previously reserved for standalone charting platforms. Another significant trend is the rise of ‘Smart Charting’ and automation within the TradingView ecosystem on Deriv.

Community-developed advanced indicators—such as the Lux Algo Smart Money Concepts—automate complex technical analysis tasks. These tools detect nuanced market structure breaks, fair value gaps, and changes of character, helping traders to spot high-probability trade setups with less manual effort, reducing emotional bias and analysis paralysis.

Education and insights from pro traders further cement these trends. Industry experts like Vince Stanzione emphasize mastery of TradingView’s advanced charts to speed up trade execution and sharpen analysis precision. Their endorsement underscores the growing recognition within the professional trading community that sophisticated charting tools are a key competitive advantage, essential for excelling in derivatives trading on platforms like Deriv.

In summary

The latest advancements in TradingView’s integration with Deriv are centered on delivering traders a highly powerful, user-friendly, and fully customizable charting environment that caters to their diverse trading needs. This enhanced environment takes full advantage of real-time market data, sophisticated automation through smart indicators, and seamless direct trading functionalities.

All these features are meticulously designed to significantly improve decision-making speed and accuracy, which are crucial for traders aiming to succeed and thrive in the fast-paced and ever-changing derivatives markets.

Practical Examples: How to Use TradingView Charts for Deriv Asset Analysis

Here is a detailed and practical step-by-step guide on how to effectively use TradingView charts for thorough Deriv asset analysis, drawing extensively on the latest up-to-date tutorials as well as valuable insights and experiences shared by expert traders from around the world:

Accessing TradingView on Deriv

- Create or log in to your Deriv account at Deriv’s Traders Hub if you don’t have one.

- From within Traders Hub, open a Deriv X account — this is essential because TradingView charts are fully integrated into Deriv X, enabling direct trading alongside advanced analysis.

- Once your Deriv X account is active, launch TradingView charts by clicking on the “+” icon, selecting “Tools” > “TradingView”, or loading a saved layout within Deriv X. You can also open the TradingView workspace directly via the web terminal option on Deriv.

- Log in with your Deriv X credentials if prompted; this links TradingView’s interface directly to your Deriv account for a seamless trading experience.

Selecting Instruments and Timeframes

- Use the TradingView watchlist on the right side of the Deriv X platform to choose your preferred instrument. This can include Deriv’s synthetic indices like the Volatility 75 Index or traditional assets such as forex pairs, commodities, or cryptocurrencies.

- Pick a timeframe that suits your trading style. Scalpers may leverage 1- or 5-minute charts to catch quick price moves, while swing traders might analyze 1-hour or daily timeframes for broader trends.

- You can open multiple charts with different assets or timeframes simultaneously for multi-market awareness.

Applying Indicators and Trendlines

- Start by adding useful technical indicators like the Relative Strength Index (RSI) or Moving Averages (MA) through the indicator menu to assess momentum and trend strength.

- Use TradingView’s powerful drawing tools to create trendlines by connecting key highs and lows on the chart. For example, when trading the Volatility 75 Index, drawing ascending trendlines connecting higher lows can identify an uptrend and potential buy zones.

- Apply additional tools such as Fibonacci retracements to locate support and resistance levels or channels to monitor price ranges. These visual aids simplify spotting breakouts or reversals.

Executing Trades Directly

- Once your technical analysis indicates a trade setup, you can place trades directly from the TradingView chart within Deriv X. On the top left of the chart interface, the red (short) and blue (long) trade buttons let you initiate positions instantly.

- Set your order type (market, limit, or stop), and define stop-loss and take-profit levels visually on the chart by dragging the order boxes, which enhances risk management.

- Confirm the trade and monitor open positions in the “Positions” tab inside Deriv X, where you can adjust stops or close trades anytime without leaving the TradingView interface.

Pro Tips:

- Use keyboard shortcuts, as demonstrated by professional traders such as Vince Stanzione, in Deriv X TradingView to significantly speed up order execution and streamline order management processes. These shortcuts allow you to quickly place, modify, and cancel orders without having to navigate through multiple menus, enhancing your trading efficiency and responsiveness in fast-moving markets.

- Make it a regular practice to customize your chart layouts in a way that perfectly suits your unique workflow, enhancing your efficiency and focus. Additionally, save these customized templates so you can quickly access your preferred indicators and drawing tools without having to set them up repeatedly each time you work. This approach ensures a streamlined and personalized charting experience every time you use the platform.

- Bookmark the website dx.deriv.com to gain quick and direct access to Deriv X as well as the fully integrated TradingView charts, ensuring a seamless and efficient trading experience every time you visit.

By carefully following these practical and well-designed steps, Deriv traders are able to fully harness and maximize the power of TradingView’s highly advanced charting and trading interface. This enables them to significantly enhance their overall market analysis capabilities, improve the timing of their trades, and execute trades quickly and efficiently—all seamlessly integrated within a single, streamlined, and user-friendly platform.

Benefits of Using Advanced TradingView Charts on Deriv

| Benefit | Description |

|---|---|

| Enhanced Analytical Depth | TradingView charts on Deriv X support real-time synchronization with your Deriv account, enabling you to place, modify, and manage trades directly from the chart interface. This reduces latency between analysis and execution, giving traders a critical edge in fast-moving markets. |

| Faster and Smarter Trade Execution | The TradingView interface offers a user-friendly design combined with extensive tutorial resources, simplifying even complex technical analysis. Integrated drawing and annotation tools make it easier to spot trends, draw support/resistance levels, and identify entry/exit points without switching platforms. |

| Reduced Complexity | Traders can analyze and trade across a wide variety of asset classes, including over 300 instruments, spanning forex, stocks, commodities, cryptocurrencies, and Deriv’s proprietary synthetic indices — all within one cohesive platform. |

| Increased Market Coverage | Beyond standard indicators, traders can leverage TradingView’s extensive community-built custom scripts and strategies. These innovative tools help automate analysis and incorporate unique trading tactics that would otherwise require complex setups. |

| Community & Custom Scripts | Beyond standard indicators, traders can leverage TradingView’s extensive community-built custom scripts and strategies. These innovative tools help automate analysis and incorporate unique trading tactics that would otherwise require complex setups |

Additional Insights

- The integration reflects Deriv’s strong commitment to providing a seamless and exceptionally powerful trading experience. At the same time, it ensures that accessibility is maintained for traders of all skill levels, making it easier for everyone to participate and benefit from the platform’s advanced features.

- Deriv’s strong focus on innovation extends to embracing broader technology trends, including sophisticated AI-driven enhancements designed to improve user experience and trading performance. However, TradingView’s advanced charting features continue to serve as a fundamental cornerstone for traders who highly value in-depth analytics, detailed insights, and precision in their market assessments.

This unique combination of powerful benefits makes TradingView charts an indispensable and essential tool for Deriv traders who are looking to analyze financial markets more efficiently, execute their trades with greater speed and accuracy, and ultimately gain a significant competitive advantage across a wide variety of diverse asset classes and investment opportunities.

FAQs

Can I use TradingView charts on Deriv without a Deriv X account?

You can access free TradingView charts on Deriv at charts.deriv.com without a Deriv X trading account. However, placing trades directly from the charts requires a Deriv X account, as TradingView integration with live trading functionality is available only on Deriv X.

What types of assets can I analyze on TradingView with Deriv?

You can analyze over 300 instruments, including forex pairs, stocks, commodities, cryptocurrencies, ETFs, and Deriv’s proprietary synthetic indices like Volatility 75 and Boom/Crash indices. This broad asset coverage enables comprehensive market research across multiple classes.

Are the TradingView tools customizable?

TradingView charts on Deriv allow you to customize chart layouts, apply over 100 technical indicators, choose from 17 chart types, and use hundreds of drawing tools. You can save your favorite layouts and configure timeframes to perfectly match your trading style and analysis needs.

How do advanced TradingView charts improve trade accuracy?

Advanced TradingView charts provide detailed visual cues such as trendlines, support and resistance levels, and integrate real-time market data. Coupled with a rich selection of technical indicators, these features help traders better time entries and exits, recognize strong setups, and reduce guesswork—ultimately improving trade precision.

Is TradingView integration free on Deriv?

Access to TradingView charts on both Deriv and Deriv X platforms is entirely free of charge once you have successfully registered and created an account. There are no extra fees or hidden costs involved when you use these advanced charting tools as an integral part of your overall trading environment. This means you can fully utilize the powerful features of TradingView charts without worrying about any additional payments.

In Conclusion

For Deriv traders aspiring to gain a genuine edge in asset analysis, integrating TradingView’s advanced charting features into your workflow is a transformative move. This integration brings a professional-grade analytical environment directly into Deriv’s platform, enabling traders to unlock:

- Dynamic chart types—adapt your perspective with candlesticks, Renko, Kagi, Heikin Ashi, and more.

- An extensive library of technical indicators—explore over 100 built-in and community-driven tools to measure momentum, trends, volatility, and key market levels.

- Sophisticated drawing and annotation tools—clarify support/resistance, identify trendlines, and map out advanced technical patterns visually.

- Real-time market data and seamless synchronization—analyze and react to live price movements and manage trades efficiently without toggling between platforms.

For Intermediate Traders

You have the opportunity to deepen and refine your trading strategies, allowing you to experiment with greater confidence using a wider variety of chart types. Additionally, you can explore and integrate new and advanced indicators into your analysis, effectively bridging the gap between basic technical analysis and gaining truly robust, comprehensive market insights that can enhance your trading decisions.

For Advanced and Pro Traders

This sophisticated setup significantly streamlines your entire workflow, dramatically accelerates the process from analysis to execution, and empowers you with the rigorous, multi-asset monitoring capabilities that are essential for maintaining and sharpening a professional trading edge in today’s fast-paced markets.

For All Ambitious Traders

TradingView’s seamless integration with Deriv represents far more than just a simple convenience; it marks a significant leap forward in analytical capabilities, offering a comprehensive suite of essential tools designed to empower traders. These tools enable smarter, faster, and far more accurate decision-making, which is crucial in navigating the complexities of today’s fast-paced and ever-evolving derivatives market.

By fully embracing and using these advanced charting resources, you position yourself to trade with significantly greater confidence, enhanced precision, and improved consistency—key hallmarks that define sustained trading success in the fast-paced and ever-changing world of derivatives.

Discover more from Skill to Grow

Subscribe to get the latest posts sent to your email.